Page 327 - Large Business IRS Training Guides

P. 327

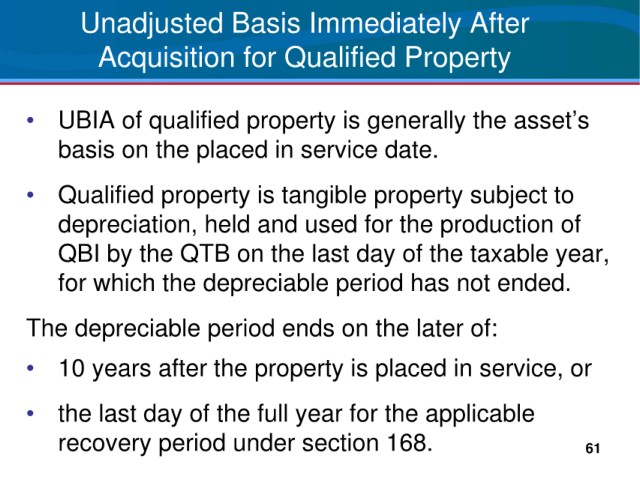

Unadjusted Basis Immediately After

Acquisition for Qualified Property

• UBIA of qualified property is generally the asset’s

basis on the placed in service date.

• Qualified property is tangible property subject to

depreciation, held and used for the production of

QBI by the QTB on the last day of the taxable year,

for which the depreciable period has not ended.

The depreciable period ends on the later of:

• 10 years after the property is placed in service, or

• the last day of the full year for the applicable

recovery period under section 168. 61