Page 453 - Large Business IRS Training Guides

P. 453

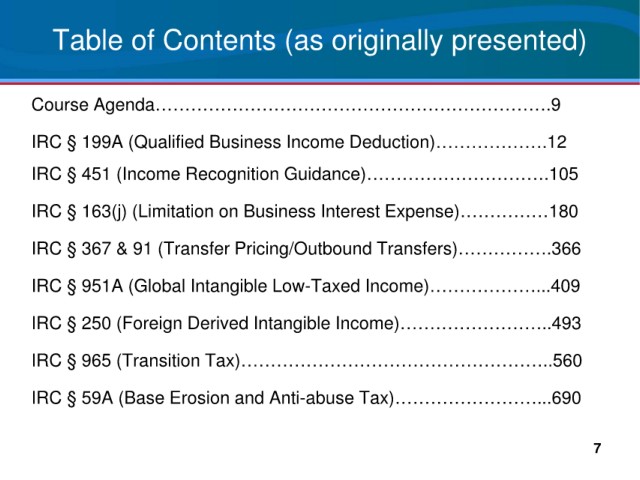

Contents (as originally presented)

Table of

Course Agenda………………………………………………………….9

IRC

§ 199A (Qualified Business Income Deduction)……………….12

IRC

§ 451 (Income Recognition Guidance)………………………….105

IRC

§ 163(j) (Limitation on Business Interest Expense)……………180

IRC

§ 367 & 91 (Transfer Pricing/Outbound Transfers)…………….366

IRC

§ 951A (Global Intangible Low-Taxed Income)………………...409

IRC

§ 250 (Foreign Derived Intangible Income)……………………..493

IRC

§ 965 (Transition Tax)……………………………………………..560

IRC

§ 59A (Base Erosion and Anti-abuse Tax)……………………...690

7