Page 480 - Large Business IRS Training Guides

P. 480

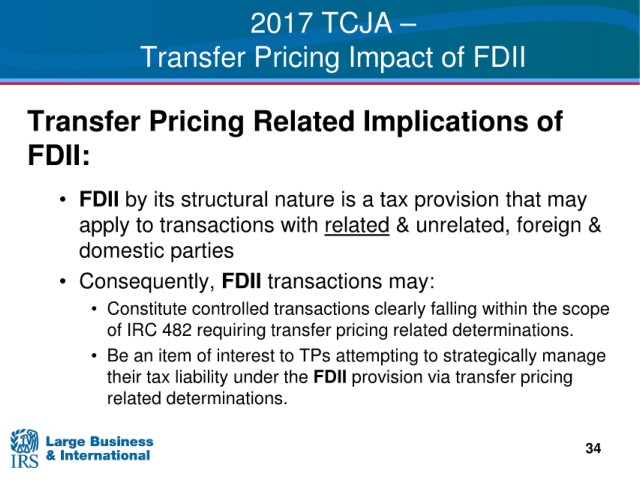

2017 TCJA

–

Transfer

Pricing Impact of FDII

Pricing Related Implications of

Transfer

FDII:

• FDII by its structural nature is a tax provision that may

apply to transactions with related & unrelated, foreign &

domestic parties

• Consequently, FDII transactions may:

clearly falling within the scope

• Constitute controlled transactions

IRC 482 requiring transfer pricing related determinations.

of

of interest to TPs attempting to strategically manage

• Be an item

tax liability under the FDII provision via transfer pricing

their

related determinations.

34