Page 494 - Large Business IRS Training Guides

P. 494

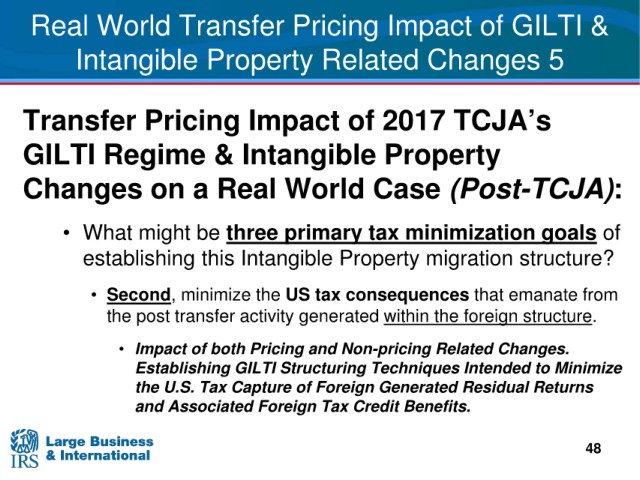

Real World Transfer

Pricing Impact of GILTI &

Intangible Property Related Changes 5

Impact of 2017 TCJA’s

Transfer Pricing

Intangible Property

GILTI Regime &

a Real World Case (Post-TCJA):

Changes on

• What might

be three primary tax minimization goals of

establishing this Intangible Property

migration structure?

• Second, minimize the US tax consequences that emanate from

the post transfer activity generated within the foreign structure.

f both Pricing and Non-pricing Related Changes.

• Impact o

Establishing

GILTI Structuring Techniques Intended to Minimize

the U.S.

Tax Capture of Foreign Generated Residual Returns

and Associated Foreign Tax Credit Benefits.

48