Page 700 - Large Business IRS Training Guides

P. 700

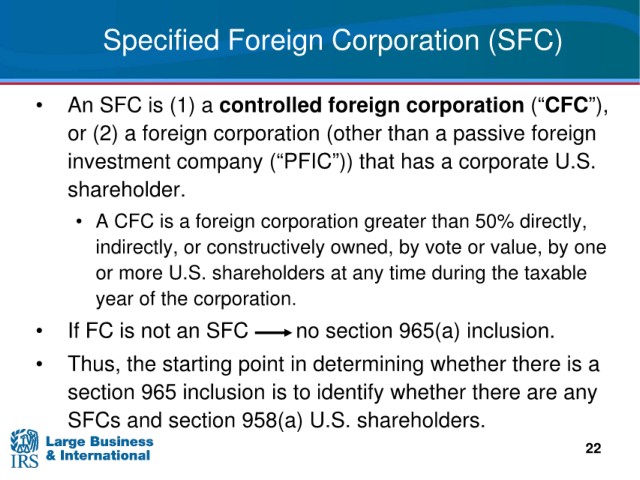

Specified Foreign Corporation (SFC)

controlled foreign corporation (“CFC”),

• An SFC is (1) a

or (2) a foreign corporation (other than a passive foreign

(“PFIC”)) that has a corporate U.S.

investment company

shareholder.

a foreign corporation greater than 50% directly,

• A CFC i s

owned, by vote or value, by one

indirectly, or constructively

at any time during the taxable

or more U.S. shareholders

year of the corporation.

no section 965(a) inclusion.

• If FC is not an SFC

• Thus, the starting point

in determining whether there is a

section 965 inclusion is to identify

whether there are any

SFCs and section 958(a)

U.S. shareholders.

22