Page 720 - Large Business IRS Training Guides

P. 720

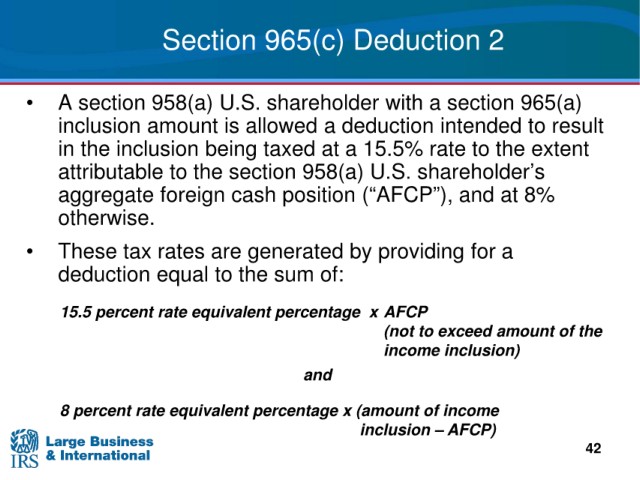

Section 965(c)

Deduction 2

• A section 958(a)

U.S. shareholder with a section 965(a)

allowed a deduction intended to result

inclusion amount i s

in the inclusion being taxed at a 15.5%

rate to the extent

U.S. shareholder’s

attributable to the section 958(a)

aggregate foreign cash position (“AFCP”),

and at 8%

otherwise.

• These tax rates

are generated by providing for a

deduction equal

to the sum of:

rate equivalent percentage x AFCP

15.5 percent

(not t o

exceed amount of the

income inclusion)

and

8 percent rate equivalent

percentage x (amount of income

– AFCP)

inclusion

42