Page 814 - Large Business IRS Training Guides

P. 814

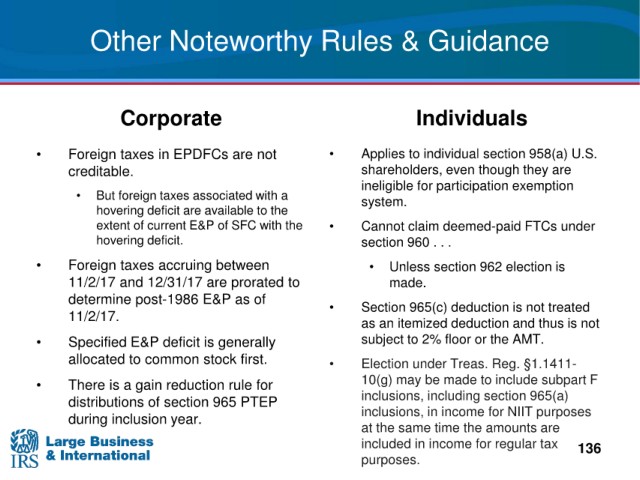

Other

Noteworthy Rules & Guidance

Corporate

Individuals

are not

section 958(a) U.S.

• Foreign taxes in EPDFCs • Applies to individual

creditable. shareholders, even though they are

ineligible for participation exemption

• But foreign taxes associated with a system.

hovering deficit are available to the

extent of current E&P of SFC with the • Cannot claim deemed-paid FTCs under

hovering deficit. section 960 . . .

• Foreign taxes accruing between • Unless section 962 election is

11/2/17 and 12/31/17 are prorated to made.

determine post-1986 E&P as of

11/2/17. • Section 965(c) deduction is not treated

as an itemized deduction and thus is not

to 2% floor or the AMT.

• Specified E&P deficit is generally subject

first.

allocated to common stock • Election under Treas. Reg. §1.1411

• There is a gain reduction rule for 10(g) may be made to include subpart F

distributions of section 965 PTEP inclusions, including section 965(a)

during inclusion year. inclusions, in income for NIIT purposes

at the same time the amounts are

included in income for regular tax 136

purposes.