Page 74 - Finanancial Management_Feb_Apr23

P. 74

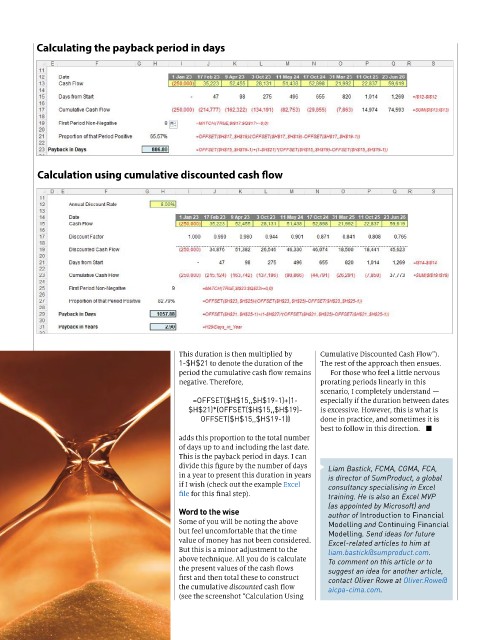

Calculating the payback period in days

Calculation using cumulative discounted cash flow

This duration is then multiplied by Cumulative Discounted Cash Flow”).

1-$H$21 to denote the duration of the The rest of the approach then ensues.

period the cumulative cash flow remains For those who feel a little nervous

negative. Therefore, prorating periods linearly in this

scenario, I completely understand —

=OFFSET($H$15,,$H$19-1)+(1- especially if the duration between dates

$H$21)*(OFFSET($H$15,,$H$19)- is excessive. However, this is what is

OFFSET($H$15,,$H$19-1)) done in practice, and sometimes it is

best to follow in this direction. n

adds this proportion to the total number

of days up to and including the last date.

This is the payback period in days. I can

divide this figure by the number of days Liam Bastick, FCMA, CGMA, FCA,

in a year to present this duration in years is director of SumProduct, a global

if I wish (check out the example Excel consultancy specialising in Excel

file for this final step). training. He is also an Excel MVP

(as appointed by Microsoft) and

Word to the wise author of Introduction to Financial

Some of you will be noting the above Modelling and Continuing Financial

but feel uncomfortable that the time Modelling. Send ideas for future

value of money has not been considered. Excel-related articles to him at

But this is a minor adjustment to the liam.bastick@sumproduct.com.

above technique. All you do is calculate To comment on this article or to

the present values of the cash flows suggest an idea for another article,

first and then total these to construct contact Oliver Rowe at Oliver.Rowe@

the cumulative discounted cash flow aicpa-cima.com.

(see the screenshot “Calculation Using