Page 133 - International Taxation IRS Training Guides

P. 133

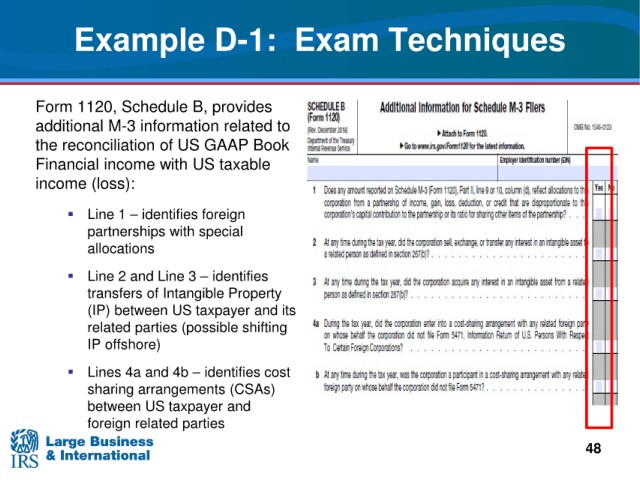

Example D-1:

Exam Techniques

Form 1120, Schedule B,

provides

additional M-3 information related to

US GAAP Book

the reconciliation of

Financial

income with US taxable

income (loss):

Line 1 – identifies foreign

partnerships with special

allocations

Line 2 and Line 3 – identifies

transfers of Intangible Property

(IP)

between US taxpayer and its

related parties (possible shifting

IP offshore)

Lines 4a and 4b – identifies cost

sharing arrangements (CSAs)

between US taxpayer and

foreign related parties

48