Page 262 - International Taxation IRS Training Guides

P. 262

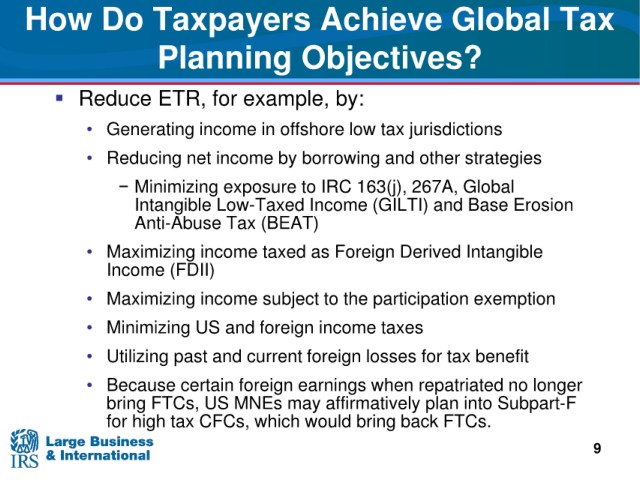

How

Do Taxpayers Achieve Global Tax

Planning Objectives?

Reduce ETR, for example,

by:

tax jurisdictions

• Generating income in offshore low

income by borrowing and other strategies

• Reducing net

− Minimizing exposure to IRC

163(j), 267A, Global

and Base Erosion

Intangible Low-Taxed Income (GILTI)

Anti-Abuse

Tax (BEAT)

Foreign Derived Intangible

• Maximizing income taxed as

Income (FDII)

to the participation exemption

• Maximizing income subject

• Minimizing US

and foreign income taxes

• Utilizing past

and current foreign losses for tax benefit

when repatriated no longer

• Because certain foreign earnings

bring FTCs,

US MNEs may affirmatively plan into Subpart-F

for

high tax CFCs, which would bring back FTCs.

9