Page 298 - International Taxation IRS Training Guides

P. 298

Possible

Transactions (Cont’d)

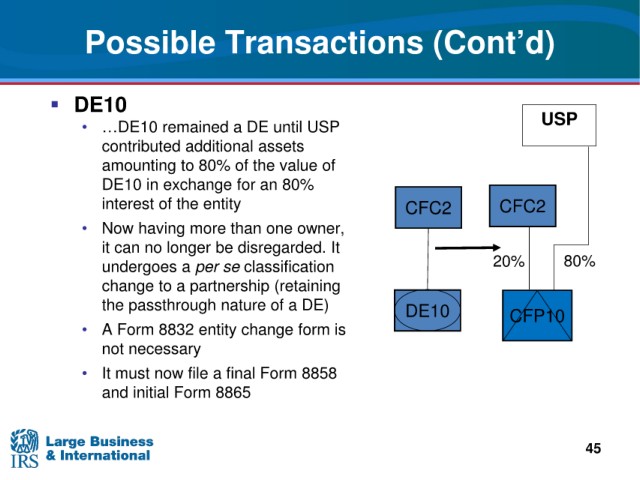

DE10

until USP

• …DE10 remained a DE USP

assets

contributed additional

of the value of

amounting to 80%

DE10 in exchange for an 80%

interest of the entity CFC2 CFC2

• Now

having more than one owner,

be disregarded. It

it can no longer

a per se classification

undergoes 20% 80%

change to a partnership (retaining

the passthrough nature of a DE) DE10 CFP10

• A Form 8832 entity change form is

not necessary

• It must now file a final Form 8858

and initial Form 8865

45