Page 64 - Family Law Services

P. 64

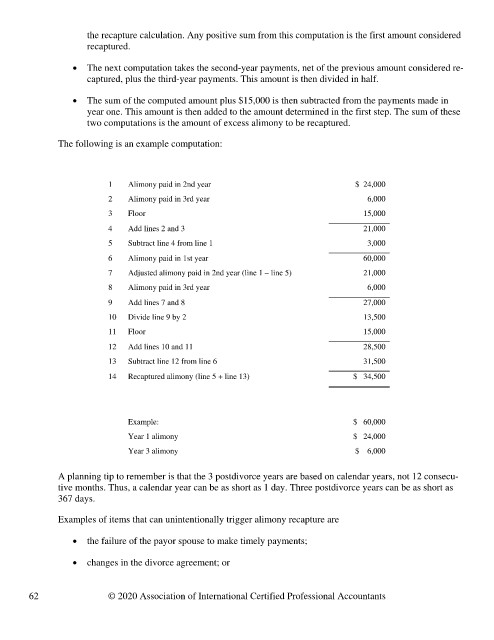

the recapture calculation. Any positive sum from this computation is the first amount considered

recaptured.

• The next computation takes the second-year payments, net of the previous amount considered re-

captured, plus the third-year payments. This amount is then divided in half.

• The sum of the computed amount plus $15,000 is then subtracted from the payments made in

year one. This amount is then added to the amount determined in the first step. The sum of these

two computations is the amount of excess alimony to be recaptured.

The following is an example computation:

1 Alimony paid in 2nd year $ 24,000

2 Alimony paid in 3rd year 6,000

3 Floor 15,000

4 Add lines 2 and 3 21,000

5 Subtract line 4 from line 1 3,000

6 Alimony paid in 1st year 60,000

7 Adjusted alimony paid in 2nd year (line 1 – line 5) 21,000

8 Alimony paid in 3rd year 6,000

9 Add lines 7 and 8 27,000

10 Divide line 9 by 2 13,500

11 Floor 15,000

12 Add lines 10 and 11 28,500

13 Subtract line 12 from line 6 31,500

14 Recaptured alimony (line 5 + line 13) $ 34,500

Example: $ 60,000

Year 1 alimony $ 24,000

Year 3 alimony $ 6,000

A planning tip to remember is that the 3 postdivorce years are based on calendar years, not 12 consecu-

tive months. Thus, a calendar year can be as short as 1 day. Three postdivorce years can be as short as

367 days.

Examples of items that can unintentionally trigger alimony recapture are

• the failure of the payor spouse to make timely payments;

• changes in the divorce agreement; or

62 © 2020 Association of International Certified Professional Accountants