Page 73 - Family Law Services

P. 73

• Legal fees

• Safe deposit box rental

• Casualty and theft losses (non-income-producing property)

TJCA temporarily repeals the overall limitation on itemized deductions for high-income taxpayers

("Pease" limitation) for tax years 2018–2025.

Allocating refunds and estimated tax payments when a joint return is filed. When income and withhold-

ing credits are generated by both the husband and the wife, if the parties do not otherwise agree, the

overpayment on the joint return must be allocated to each spouse to the extent that he or she contributed

to the overpaid amount.

If a taxpayer and spouse file a joint return showing an overpayment, then the amount that may be credit-

ed to one spouse's separate liability is computed by subtracting the spouse's share of the joint liability, as

determined in accordance with the separate tax formula, from the spouse's contribution toward the joint

liability (see Revenue Ruling 80-7, 1980-1 CB 296, IRC Section 6402). The amount credited cannot ex-

ceed the amount of the joint overpayment.

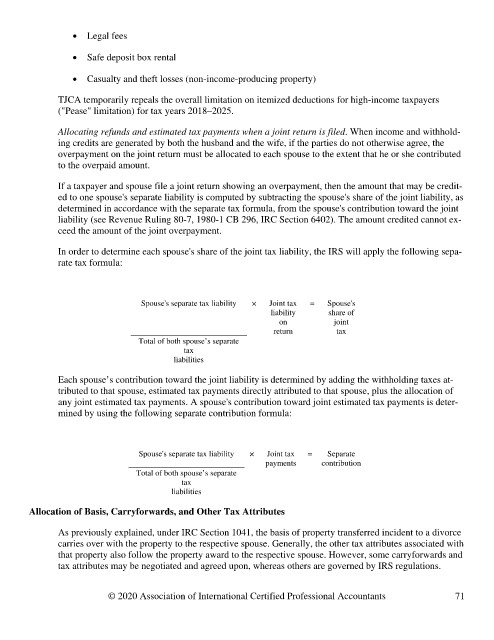

In order to determine each spouse's share of the joint tax liability, the IRS will apply the following sepa-

rate tax formula:

Spouse's separate tax liability × Joint tax = Spouse's

liability share of

on joint

return tax

Total of both spouse’s separate

tax

liabilities

Each spouse’s contribution toward the joint liability is determined by adding the withholding taxes at-

tributed to that spouse, estimated tax payments directly attributed to that spouse, plus the allocation of

any joint estimated tax payments. A spouse's contribution toward joint estimated tax payments is deter-

mined by using the following separate contribution formula:

Spouse's separate tax liability × Joint tax = Separate

payments contribution

Total of both spouse’s separate

tax

liabilities

Allocation of Basis, Carryforwards, and Other Tax Attributes

As previously explained, under IRC Section 1041, the basis of property transferred incident to a divorce

carries over with the property to the respective spouse. Generally, the other tax attributes associated with

that property also follow the property award to the respective spouse. However, some carryforwards and

tax attributes may be negotiated and agreed upon, whereas others are governed by IRS regulations.

© 2020 Association of International Certified Professional Accountants 71