Page 169 - Tax Reform

P. 169

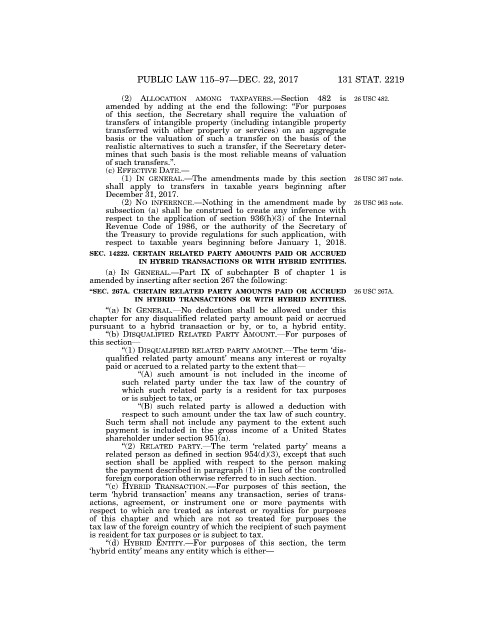

PUBLIC LAW 115–97—DEC. 22, 2017 131 STAT. 2219

(2) ALLOCATION AMONG TAXPAYERS.—Section 482 is 26 USC 482.

amended by adding at the end the following: ‘‘For purposes

of this section, the Secretary shall require the valuation of

transfers of intangible property (including intangible property

transferred with other property or services) on an aggregate

basis or the valuation of such a transfer on the basis of the

realistic alternatives to such a transfer, if the Secretary deter-

mines that such basis is the most reliable means of valuation

of such transfers.’’.

(c) EFFECTIVE DATE.—

(1) IN GENERAL.—The amendments made by this section 26 USC 367 note.

shall apply to transfers in taxable years beginning after

December 31, 2017.

(2) NO INFERENCE.—Nothing in the amendment made by 26 USC 963 note.

subsection (a) shall be construed to create any inference with

respect to the application of section 936(h)(3) of the Internal

Revenue Code of 1986, or the authority of the Secretary of

the Treasury to provide regulations for such application, with

respect to taxable years beginning before January 1, 2018.

SEC. 14222. CERTAIN RELATED PARTY AMOUNTS PAID OR ACCRUED

IN HYBRID TRANSACTIONS OR WITH HYBRID ENTITIES.

(a) IN GENERAL.—Part IX of subchapter B of chapter 1 is

amended by inserting after section 267 the following:

‘‘SEC. 267A. CERTAIN RELATED PARTY AMOUNTS PAID OR ACCRUED 26 USC 267A.

IN HYBRID TRANSACTIONS OR WITH HYBRID ENTITIES.

‘‘(a) IN GENERAL.—No deduction shall be allowed under this

chapter for any disqualified related party amount paid or accrued

pursuant to a hybrid transaction or by, or to, a hybrid entity.

‘‘(b) DISQUALIFIED RELATED PARTY AMOUNT.—For purposes of

this section—

‘‘(1) DISQUALIFIED RELATED PARTY AMOUNT.—The term ‘dis-

qualified related party amount’ means any interest or royalty

paid or accrued to a related party to the extent that—

‘‘(A) such amount is not included in the income of

such related party under the tax law of the country of

which such related party is a resident for tax purposes

or is subject to tax, or

‘‘(B) such related party is allowed a deduction with

respect to such amount under the tax law of such country.

Such term shall not include any payment to the extent such

payment is included in the gross income of a United States

shareholder under section 951(a).

‘‘(2) RELATED PARTY.—The term ‘related party’ means a

related person as defined in section 954(d)(3), except that such

section shall be applied with respect to the person making

the payment described in paragraph (1) in lieu of the controlled

foreign corporation otherwise referred to in such section.

‘‘(c) HYBRID TRANSACTION.—For purposes of this section, the

term ‘hybrid transaction’ means any transaction, series of trans-

actions, agreement, or instrument one or more payments with

respect to which are treated as interest or royalties for purposes

of this chapter and which are not so treated for purposes the

tax law of the foreign country of which the recipient of such payment

is resident for tax purposes or is subject to tax.

dkrause on DSKBC28HB2PROD with PUBLAWS VerDate Sep 11 2014 10:09 Oct 18, 2018 Jkt 079139 PO 00097 Frm 00167 Fmt 6580 Sfmt 6581 E:\PUBLAW\PUBL097.115 PUBL097

‘‘(d) HYBRID ENTITY.—For purposes of this section, the term

‘hybrid entity’ means any entity which is either—