Page 518 - COSO Guidance Book

P. 518

8 | Developing Key Risk Indicators to Strengthen Enterprise Risk Management | Thought Leadership in ERM

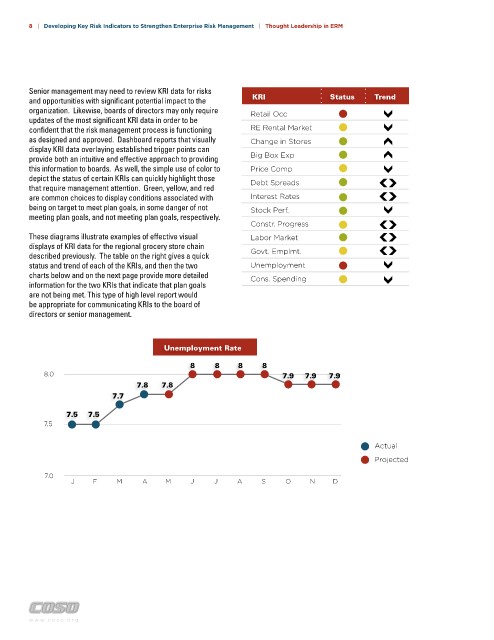

Senior management may need to review KRI data for risks

and opportunities with significant potential impact to the KRI Status Trend

organization. Likewise, boards of directors may only require Retail Occ

updates of the most significant KRI data in order to be

confident that the risk management process is functioning RE Rental Market

as designed and approved. Dashboard reports that visually Change in Stores

display KRI data overlaying established trigger points can

provide both an intuitive and effective approach to providing Big Box Exp

this information to boards. As well, the simple use of color to Price Comp

depict the status of certain KRIs can quickly highlight those Debt Spreads

that require management attention. Green, yellow, and red

are common choices to display conditions associated with Interest Rates

being on target to meet plan goals, in some danger of not Stock Perf.

meeting plan goals, and not meeting plan goals, respectively.

Constr. Progress

These diagrams illustrate examples of effective visual Labor Market

displays of KRI data for the regional grocery store chain Govt. Emplmt.

described previously. The table on the right gives a quick

status and trend of each of the KRIs, and then the two Unemployment

charts below and on the next page provide more detailed Cons. Spending

information for the two KRIs that indicate that plan goals

are not being met. This type of high level report would

be appropriate for communicating KRIs to the board of

directors or senior management.

Unemployment Rate

8 8 8 8

8.0 7.9 7.9 7.9

7.8 7.8

7.7

7.5 7.5

7.5

Actual

Projected

7.0

J F M A M J J A S O N D

Retail Occupancy %

90 88 88

86

85 85

85 84

82 82

80 80 80 81 Actual

80

Projected

75

J F M A M J J A S O N D

w w w . c o s o . o r g