Page 25 - IRS Individual Tax Forms

P. 25

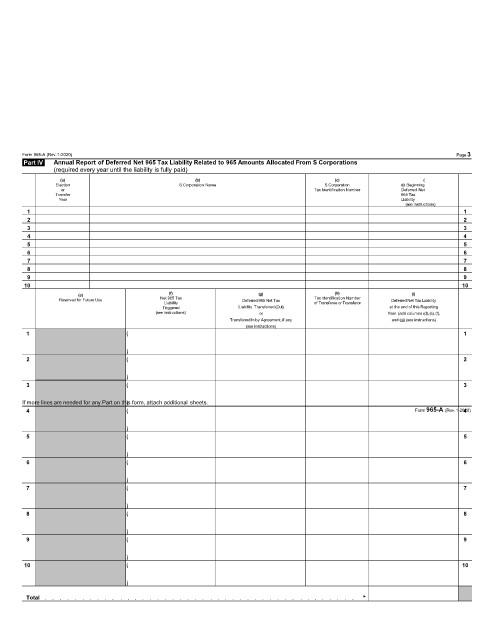

Form 965-A (Rev.1-2020) Page 3

Part IV Annual Report of Deferred Net 965 Tax Liability Related to 965 Amounts Allocated From S Corporations

(required every year until the liability is fully paid)

(a) (b) (c) (

Election S Corporation Name S Corporation d) Beginning

or Tax Identification Number Deferred Net

Transfer 965 Tax

Year Liability

(see instructions)

1 1

2 2

3 3

4 4

5 5

6 6

7 7

8 8

9 9

10 10

(e) (f) (g) (h) (i)

Tax Identification Number

Reserved for Future Use Net 965 Tax Deferred 965 Net Tax of Transferee or Transferor Deferred Net Tax Liability

Liability

Triggered Liability Transferred (Out) at the end of this Reporting

(see instructions) or Year (add columns (d), (e), (f),

Transferred In by Agreement, if any and (g)) (see instructions)

(see instructions)

1 ( 1

)

2 ( 2

)

3 ( 3

)

If more lines are needed for any Part on this form, attach additional sheets.

4

4 ( Form 965-A (Rev.1-2020)

)

5 ( 5

)

6 ( 6

)

7 ( 7

)

8 ( 8

)

9 ( 9

)

10 ( 10

)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶