Page 20 - Interest Income - Individuals

P. 20

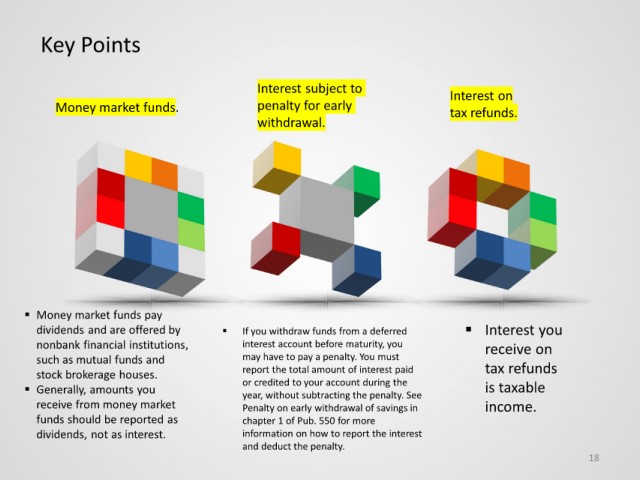

Key Points

Interest subject to Interest on

Money market funds. penalty for early tax refunds.

withdrawal.

Money market funds pay

dividends and are offered by If you withdraw funds from a deferred Interest you

nonbank financial institutions, interest account before maturity, you receive on

such as mutual funds and may have to pay a penalty. You must

stock brokerage houses. report the total amount of interest paid tax refunds

Generally, amounts you or credited to your account during the is taxable

year, without subtracting the penalty. See

receive from money market Penalty on early withdrawal of savings in income.

funds should be reported as chapter 1 of Pub. 550 for more

dividends, not as interest. information on how to report the interest

and deduct the penalty.

18