Page 53 - Interest Income - Individuals

P. 53

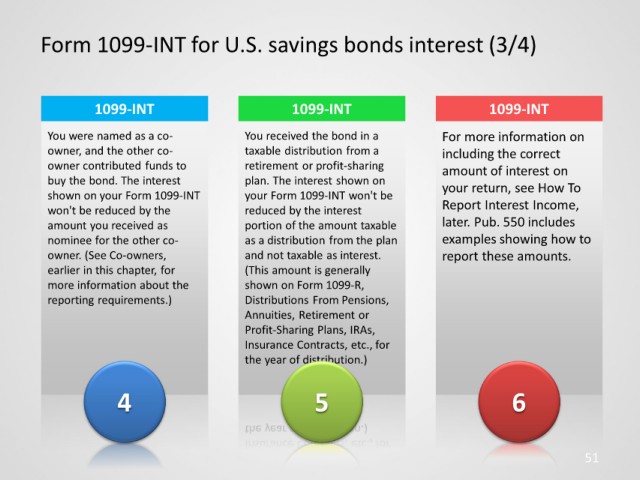

Form 1099-INT for U.S. savings bonds interest (3/4)

1099-INT 1099-INT 1099-INT

You were named as a co- You received the bond in a For more information on

owner, and the other co- taxable distribution from a including the correct

owner contributed funds to retirement or profit-sharing amount of interest on

buy the bond. The interest plan. The interest shown on your return, see How To

shown on your Form 1099-INT your Form 1099-INT won't be

won't be reduced by the reduced by the interest Report Interest Income,

amount you received as portion of the amount taxable later. Pub. 550 includes

nominee for the other co- as a distribution from the plan examples showing how to

owner. (See Co-owners, and not taxable as interest. report these amounts.

earlier in this chapter, for (This amount is generally

more information about the shown on Form 1099-R,

reporting requirements.) Distributions From Pensions,

Annuities, Retirement or

Profit-Sharing Plans, IRAs,

Insurance Contracts, etc., for

the year of distribution.)

4 5 6

51