Page 101 - Form W4 and payroll Tables

P. 101

12:15 - 8-Dec-2020

Page 51 of 66

Fileid: … tions/P15T/2021/A/XML/Cycle06/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

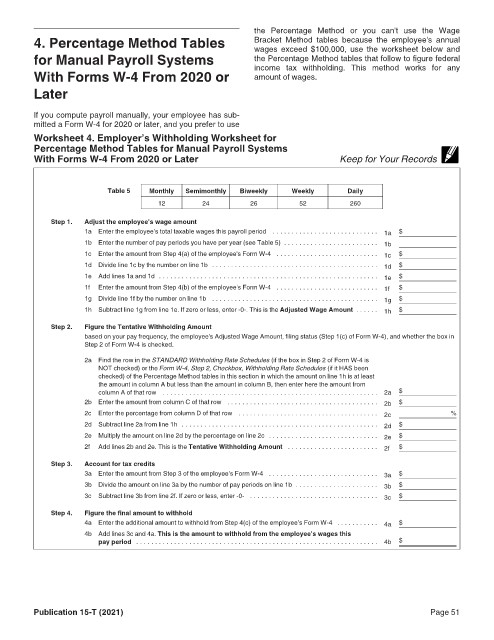

the Percentage Method or you can't use the Wage

4. Percentage Method Tables Bracket Method tables because the employee's annual

wages exceed $100,000, use the worksheet below and

for Manual Payroll Systems the Percentage Method tables that follow to figure federal

With Forms W-4 From 2020 or income tax withholding. This method works for any

amount of wages.

Later

If you compute payroll manually, your employee has sub-

mitted a Form W-4 for 2020 or later, and you prefer to use

Worksheet 4. Employer’s Withholding Worksheet for

Percentage Method Tables for Manual Payroll Systems

With Forms W-4 From 2020 or Later Keep for Your Records

Table 5 Monthly Semimonthly Biweekly Weekly Daily

12 24 26 52 260

Step 1. Adjust the employee’s wage amount

1a Enter the employee’s total taxable wages this payroll period . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a $

1b Enter the number of pay periods you have per year (see Table 5) . . . . . . . . . . . . . . . . . . . . . . . . . 1b

1c Enter the amount from Step 4(a) of the employee's Form W-4 . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c $

1d Divide line 1c by the number on line 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1d $

1e Add lines 1a and 1d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1e $

1f Enter the amount from Step 4(b) of the employee's Form W-4 . . . . . . . . . . . . . . . . . . . . . . . . . . . 1f $

1g Divide line 1f by the number on line 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1g $

1h Subtract line 1g from line 1e. If zero or less, enter -0-. This is the Adjusted Wage Amount . . . . . . 1h $

Step 2. Figure the Tentative Withholding Amount

based on your pay frequency, the employee's Adjusted Wage Amount, filing status (Step 1(c) of Form W-4), and whether the box in

Step 2 of Form W-4 is checked.

2a Find the row in the STANDARD Withholding Rate Schedules (if the box in Step 2 of Form W-4 is

NOT checked) or the Form W-4, Step 2, Checkbox, Withholding Rate Schedules (if it HAS been

checked) of the Percentage Method tables in this section in which the amount on line 1h is at least

the amount in column A but less than the amount in column B, then enter here the amount from

column A of that row . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a $

2b Enter the amount from column C of that row . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b $

2c Enter the percentage from column D of that row . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c %

2d Subtract line 2a from line 1h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2d $

2e Multiply the amount on line 2d by the percentage on line 2c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2e $

2f Add lines 2b and 2e. This is the Tentative Withholding Amount . . . . . . . . . . . . . . . . . . . . . . . . 2f $

Step 3. Account for tax credits

3a Enter the amount from Step 3 of the employee’s Form W-4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3a $

3b Divide the amount on line 3a by the number of pay periods on line 1b . . . . . . . . . . . . . . . . . . . . . . 3b $

3c Subtract line 3b from line 2f. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3c $

Step 4. Figure the final amount to withhold

4a Enter the additional amount to withhold from Step 4(c) of the employee’s Form W-4 . . . . . . . . . . . 4a $

4b Add lines 3c and 4a. This is the amount to withhold from the employee’s wages this

pay period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b $

Publication 15-T (2021) Page 51