Page 54 - Filing Status for Individuals

P. 54

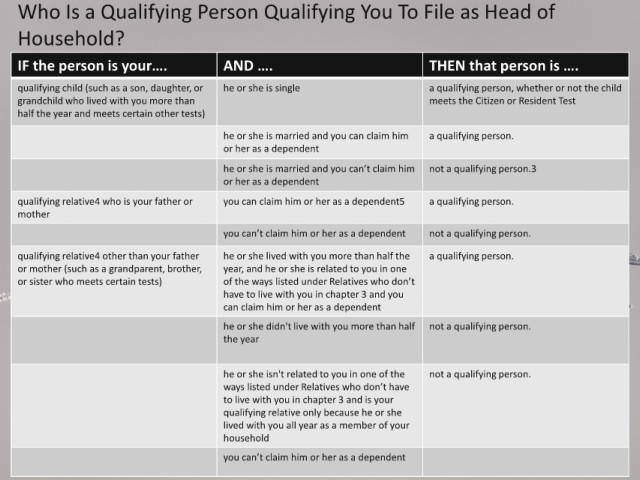

Who Is a Qualifying Person Qualifying You To File as Head of

Household?

IF the person is your…. AND …. THEN that person is ….

qualifying child (such as a son, daughter, or he or she is single a qualifying person, whether or not the child

grandchild who lived with you more than meets the Citizen or Resident Test

half the year and meets certain other tests)

he or she is married and you can claim him a qualifying person.

or her as a dependent

he or she is married and you can’t claim him not a qualifying person.3

or her as a dependent

qualifying relative4 who is your father or you can claim him or her as a dependent5 a qualifying person.

mother

you can’t claim him or her as a dependent not a qualifying person.

qualifying relative4 other than your father he or she lived with you more than half the a qualifying person.

or mother (such as a grandparent, brother, year, and he or she is related to you in one

or sister who meets certain tests) of the ways listed under Relatives who don’t

have to live with you in chapter 3 and you

can claim him or her as a dependent

he or she didn't live with you more than half not a qualifying person.

the year

he or she isn't related to you in one of the not a qualifying person.

ways listed under Relatives who don’t have

to live with you in chapter 3 and is your

qualifying relative only because he or she

lived with you all year as a member of your

household

you can’t claim him or her as a dependent 52