Page 39 - M & A Disputes

P. 39

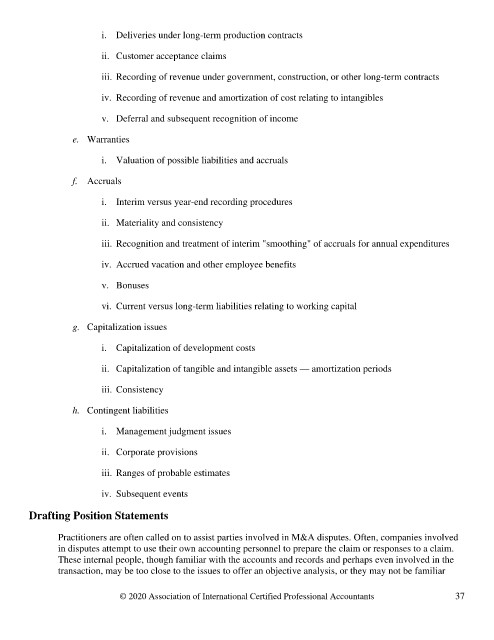

i. Deliveries under long-term production contracts

ii. Customer acceptance claims

iii. Recording of revenue under government, construction, or other long-term contracts

iv. Recording of revenue and amortization of cost relating to intangibles

v. Deferral and subsequent recognition of income

e. Warranties

i. Valuation of possible liabilities and accruals

f. Accruals

i. Interim versus year-end recording procedures

ii. Materiality and consistency

iii. Recognition and treatment of interim "smoothing" of accruals for annual expenditures

iv. Accrued vacation and other employee benefits

v. Bonuses

vi. Current versus long-term liabilities relating to working capital

g. Capitalization issues

i. Capitalization of development costs

ii. Capitalization of tangible and intangible assets — amortization periods

iii. Consistency

h. Contingent liabilities

i. Management judgment issues

ii. Corporate provisions

iii. Ranges of probable estimates

iv. Subsequent events

Drafting Position Statements

Practitioners are often called on to assist parties involved in M&A disputes. Often, companies involved

in disputes attempt to use their own accounting personnel to prepare the claim or responses to a claim.

These internal people, though familiar with the accounts and records and perhaps even involved in the

transaction, may be too close to the issues to offer an objective analysis, or they may not be familiar

© 2020 Association of International Certified Professional Accountants 37