Page 54 - M & A Disputes

P. 54

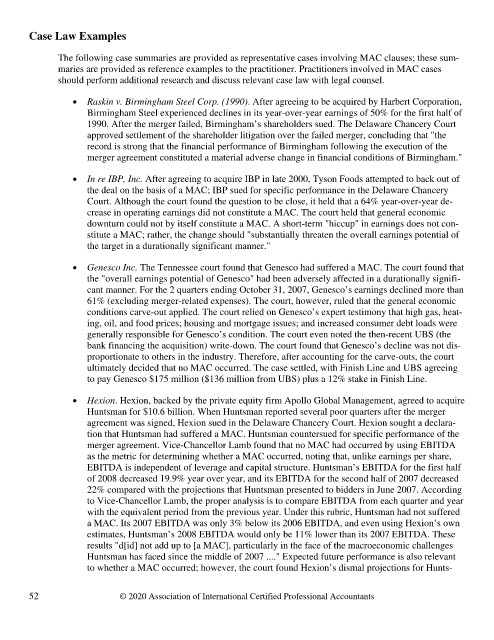

Case Law Examples

The following case summaries are provided as representative cases involving MAC clauses; these sum-

maries are provided as reference examples to the practitioner. Practitioners involved in MAC cases

should perform additional research and discuss relevant case law with legal counsel.

Raskin v. Birmingham Steel Corp. (1990). After agreeing to be acquired by Harbert Corporation,

Birmingham Steel experienced declines in its year-over-year earnings of 50% for the first half of

1990. After the merger failed, Birmingham’s shareholders sued. The Delaware Chancery Court

approved settlement of the shareholder litigation over the failed merger, concluding that "the

record is strong that the financial performance of Birmingham following the execution of the

merger agreement constituted a material adverse change in financial conditions of Birmingham."

In re IBP, Inc. After agreeing to acquire IBP in late 2000, Tyson Foods attempted to back out of

the deal on the basis of a MAC; IBP sued for specific performance in the Delaware Chancery

Court. Although the court found the question to be close, it held that a 64% year-over-year de-

crease in operating earnings did not constitute a MAC. The court held that general economic

downturn could not by itself constitute a MAC. A short-term "hiccup" in earnings does not con-

stitute a MAC; rather, the change should "substantially threaten the overall earnings potential of

the target in a durationally significant manner."

Genesco Inc. The Tennessee court found that Genesco had suffered a MAC. The court found that

the "overall earnings potential of Genesco" had been adversely affected in a durationally signifi-

cant manner. For the 2 quarters ending October 31, 2007, Genesco’s earnings declined more than

61% (excluding merger-related expenses). The court, however, ruled that the general economic

conditions carve-out applied. The court relied on Genesco’s expert testimony that high gas, heat-

ing, oil, and food prices; housing and mortgage issues; and increased consumer debt loads were

generally responsible for Genesco’s condition. The court even noted the then-recent UBS (the

bank financing the acquisition) write-down. The court found that Genesco’s decline was not dis-

proportionate to others in the industry. Therefore, after accounting for the carve-outs, the court

ultimately decided that no MAC occurred. The case settled, with Finish Line and UBS agreeing

to pay Genesco $175 million ($136 million from UBS) plus a 12% stake in Finish Line.

Hexion. Hexion, backed by the private equity firm Apollo Global Management, agreed to acquire

Huntsman for $10.6 billion. When Huntsman reported several poor quarters after the merger

agreement was signed, Hexion sued in the Delaware Chancery Court. Hexion sought a declara-

tion that Huntsman had suffered a MAC. Huntsman countersued for specific performance of the

merger agreement. Vice-Chancellor Lamb found that no MAC had occurred by using EBITDA

as the metric for determining whether a MAC occurred, noting that, unlike earnings per share,

EBITDA is independent of leverage and capital structure. Huntsman’s EBITDA for the first half

of 2008 decreased 19.9% year over year, and its EBITDA for the second half of 2007 decreased

22% compared with the projections that Huntsman presented to bidders in June 2007. According

to Vice-Chancellor Lamb, the proper analysis is to compare EBITDA from each quarter and year

with the equivalent period from the previous year. Under this rubric, Huntsman had not suffered

a MAC. Its 2007 EBITDA was only 3% below its 2006 EBITDA, and even using Hexion’s own

estimates, Huntsman’s 2008 EBITDA would only be 11% lower than its 2007 EBITDA. These

results "d[id] not add up to [a MAC], particularly in the face of the macroeconomic challenges

Huntsman has faced since the middle of 2007 ...." Expected future performance is also relevant

to whether a MAC occurred; however, the court found Hexion’s dismal projections for Hunts-

52 © 2020 Association of International Certified Professional Accountants