Page 65 - M & A Disputes

P. 65

iv. What were the factors influencing the subsequent performance?

These factors are intended to provide general guidance. It is important for the practitioner to consider all

the facts and circumstances specific to each case when assessing damages associated with the dispute.

The following case study illustrates the calculation of economic damages based on certain indemnifica-

tion claims made by a buyer.

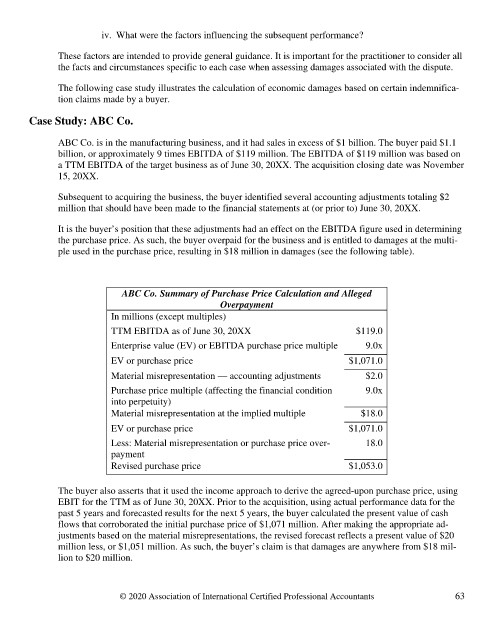

Case Study: ABC Co.

ABC Co. is in the manufacturing business, and it had sales in excess of $1 billion. The buyer paid $1.1

billion, or approximately 9 times EBITDA of $119 million. The EBITDA of $119 million was based on

a TTM EBITDA of the target business as of June 30, 20XX. The acquisition closing date was November

15, 20XX.

Subsequent to acquiring the business, the buyer identified several accounting adjustments totaling $2

million that should have been made to the financial statements at (or prior to) June 30, 20XX.

It is the buyer’s position that these adjustments had an effect on the EBITDA figure used in determining

the purchase price. As such, the buyer overpaid for the business and is entitled to damages at the multi-

ple used in the purchase price, resulting in $18 million in damages (see the following table).

ABC Co. Summary of Purchase Price Calculation and Alleged

Overpayment

In millions (except multiples)

TTM EBITDA as of June 30, 20XX $119.0

Enterprise value (EV) or EBITDA purchase price multiple 9.0x

EV or purchase price $1,071.0

Material misrepresentation — accounting adjustments $2.0

Purchase price multiple (affecting the financial condition 9.0x

into perpetuity)

Material misrepresentation at the implied multiple $18.0

EV or purchase price $1,071.0

Less: Material misrepresentation or purchase price over- 18.0

payment

Revised purchase price $1,053.0

The buyer also asserts that it used the income approach to derive the agreed-upon purchase price, using

EBIT for the TTM as of June 30, 20XX. Prior to the acquisition, using actual performance data for the

past 5 years and forecasted results for the next 5 years, the buyer calculated the present value of cash

flows that corroborated the initial purchase price of $1,071 million. After making the appropriate ad-

justments based on the material misrepresentations, the revised forecast reflects a present value of $20

million less, or $1,051 million. As such, the buyer’s claim is that damages are anywhere from $18 mil-

lion to $20 million.

© 2020 Association of International Certified Professional Accountants 63