Page 201 - Small Business IRS Training Guides

P. 201

Qualified Business Income Deduction

HOW TO FIGURE THE DEDUCTION?

QBI COMPONENT

Qualified Trades or Businesses

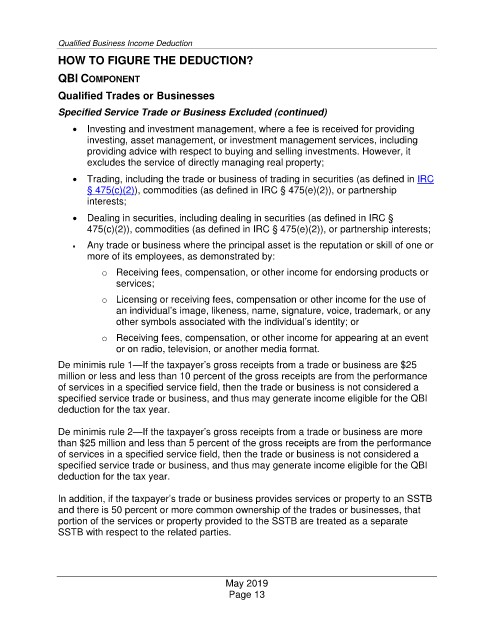

Specified Service Trade or Business Excluded (continued)

• Investing and investment management, where a fee is received for providing

investing, asset management, or investment management services, including

providing advice with respect to buying and selling investments. However, it

excludes the service of directly managing real property;

• Trading, including the trade or business of trading in securities (as defined in IRC

§ 475(c)(2)), commodities (as defined in IRC § 475(e)(2)), or partnership

interests;

• Dealing in securities, including dealing in securities (as defined in IRC §

475(c)(2)), commodities (as defined in IRC § 475(e)(2)), or partnership interests;

• Any trade or business where the principal asset is the reputation or skill of one or

more of its employees, as demonstrated by:

o Receiving fees, compensation, or other income for endorsing products or

services;

o Licensing or receiving fees, compensation or other income for the use of

an individual’s image, likeness, name, signature, voice, trademark, or any

other symbols associated with the individual’s identity; or

o Receiving fees, compensation, or other income for appearing at an event

or on radio, television, or another media format.

De minimis rule 1—If the taxpayer’s gross receipts from a trade or business are $25

million or less and less than 10 percent of the gross receipts are from the performance

of services in a specified service field, then the trade or business is not considered a

specified service trade or business, and thus may generate income eligible for the QBI

deduction for the tax year.

De minimis rule 2—If the taxpayer’s gross receipts from a trade or business are more

than $25 million and less than 5 percent of the gross receipts are from the performance

of services in a specified service field, then the trade or business is not considered a

specified service trade or business, and thus may generate income eligible for the QBI

deduction for the tax year.

In addition, if the taxpayer’s trade or business provides services or property to an SSTB

and there is 50 percent or more common ownership of the trades or businesses, that

portion of the services or property provided to the SSTB are treated as a separate

SSTB with respect to the related parties.

May 2019

Page 13