Page 278 - Small Business IRS Training Guides

P. 278

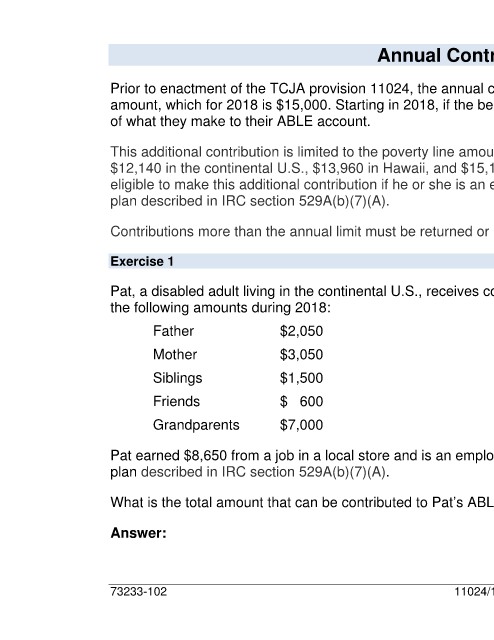

Annual Contribution Limit

Prior to enactment of the TCJA provision 11024, the annual contribution limit was tied exclusively to the gift tax exclusion

amount, which for 2018 is $15,000. Starting in 2018, if the beneficiary works, the beneficiary can also contribute part or all

of what they make to their ABLE account.

This additional contribution is limited to the poverty line amount for a one-person household. For 2018, this amount is

$12,140 in the continental U.S., $13,960 in Hawaii, and $15,180 in Alaska. However, the designated beneficiary is not

eligible to make this additional contribution if he or she is an employee with respect to whom a contribution is made to a

plan described in IRC section 529A(b)(7)(A).

Contributions more than the annual limit must be returned or may be subject to a 6 percent excise tax.

Exercise 1

Pat, a disabled adult living in the continental U.S., receives contributions to an ABLE account from friends and family in

the following amounts during 2018:

Father $2,050

Mother $3,050

Siblings $1,500

Friends $ 600

Grandparents $7,000

Pat earned $8,650 from a job in a local store and is an employee with respect to whom no contributions are made to a

plan described in IRC section 529A(b)(7)(A).

What is the total amount that can be contributed to Pat’s ABLE account in 2018?

Answer:

73233-102 11024/11025-3 Tax Cuts and Jobs Act