Page 30 - Supplement to Income Tax TY2021

P. 30

Form 1040-SR

Form 1040-SR (2020) Page 4

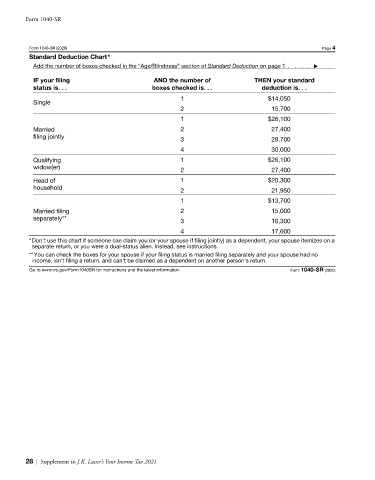

Standard Deduction Chart*

Add the number of boxes checked in the “Age/Blindness” section of Standard Deduction on page 1 . . . . ▶

IF your filing AND the number of THEN your standard

status is. . . boxes checked is. . . deduction is. . .

1 $14,050

Single

2 15,700

1 $26,100

2 27,400

Married

filing jointly 3 28,700

4 30,000

Qualifying 1 $26,100

widow(er) 2 27,400

1 $20,300

Head of

household 2 21,950

1 $13,700

2 15,000

Married filing

separately** 3 16,300

4 17,600

*Don’t use this chart if someone can claim you (or your spouse if filing jointly) as a dependent, your spouse itemizes on a

separate return, or you were a dual-status alien. Instead, see instructions.

**You can check the boxes for your spouse if your filing status is married filing separately and your spouse had no

income, isn’t filing a return, and can’t be claimed as a dependent on another person’s return.

Go to www.irs.gov/Form1040SR for instructions and the latest information. Form 1040-SR (2020)

28 | Supplement to J.K. Lasser’s Your Income Tax 2021