Page 5 - Maybank Private Pitch Book

P. 5

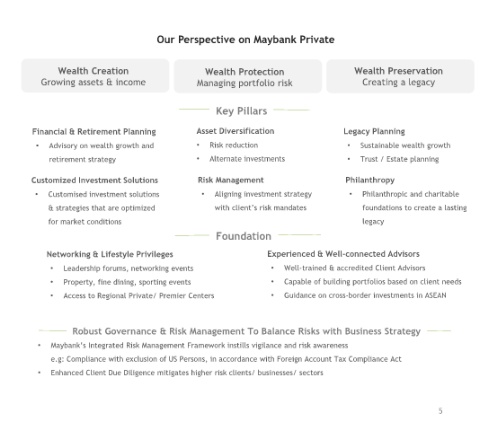

Our Perspective on Maybank Private

Wealth Creation Wealth Protection Wealth Preservation

Growing assets & income Managing portfolio risk Creating a legacy

Key Pillars

Financial & Retirement Planning Asset Diversification Legacy Planning

▪ Advisory on wealth growth and • Risk reduction • Sustainable wealth growth

retirement strategy • Alternate investments • Trust / Estate planning

Customized Investment Solutions Risk Management Philanthropy

• Customised investment solutions • Aligning investment strategy • Philanthropic and charitable

& strategies that are optimized with client’s risk mandates foundations to create a lasting

for market conditions legacy

Foundation

Networking & Lifestyle Privileges Experienced & Well-connected Advisors

• Leadership forums, networking events • Well-trained & accredited Client Advisors

• Property, fine dining, sporting events • Capable of building portfolios based on client needs

• Access to Regional Private/ Premier Centers • Guidance on cross-border investments in ASEAN

Robust Governance & Risk Management To Balance Risks with Business Strategy

• Maybank’s Integrated Risk Management Framework instills vigilance and risk awareness

e.g: Compliance with exclusion of US Persons, in accordance with Foreign Account Tax Compliance Act

• Enhanced Client Due Diligence mitigates higher risk clients/ businesses/ sectors

5