Page 23 - ForeclosurePreventionGuide_Final _Neat

P. 23

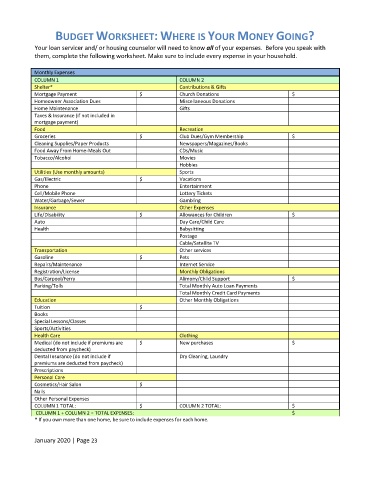

BUDGET WORKSHEET: WHERE IS YOUR MONEY GOING?

Your loan servicer and/ or housing counselor will need to know all of your expenses. Before you speak with

them, complete the following worksheet. Make sure to include every expense in your household.

Monthly Expenses

COLUMN 1 COLUMN 2

Shelter* Contributions & Gifts

Mortgage Payment $ Church Donations $

Homeowner Association Dues Miscellaneous Donations

Home Maintenance Gifts

Taxes & Insurance (if not included in

mortgage payment)

Food Recreation

Groceries $ Club Dues/Gym Membership $

Cleaning Supplies/Paper Products Newspapers/Magazines/Books

Food Away From Home-Meals Out CDs/Music

Tobacco/Alcohol Movies

Hobbies

Utilities (Use monthly amounts) Sports

Gas/Electric $ Vacations

Phone Entertainment

Cell/Mobile Phone Lottery Tickets

Water/Garbage/Sewer Gambling

Insurance Other Expenses

Life/Disability $ Allowances for Children $

Auto Day Care/Child Care

Health Babysitting

Postage

Cable/Satellite TV

Transportation Other services

Gasoline $ Pets

Repairs/Maintenance Internet Service

Registration/License Monthly Obligations

Bus/Carpool/Ferry Alimony/Child Support $

Parking/Tolls Total Monthly Auto Loan Payments

Total Monthly Credit Card Payments

Education Other Monthly Obligations

Tuition $

Books

Special Lessons/Classes

Sports/Activities

Health Care Clothing

Medical (do not include if premiums are $ New purchases $

deducted from paycheck)

Dental Insurance (do not include if Dry Cleaning, Laundry

premiums are deducted from paycheck)

Prescriptions

Personal Care

Cosmetics/Hair Salon $

Nails

Other Personal Expenses

COLUMN 1 TOTAL: $ COLUMN 2 TOTAL: $

COLUMN 1 + COLUMN 2 = TOTAL EXPENSES: $

* If you own more than one home, be sure to include expenses for each home.

January 2020 | Page 23