Page 61 - Arthyog_FilBook_05 05 2024 (1)

P. 61

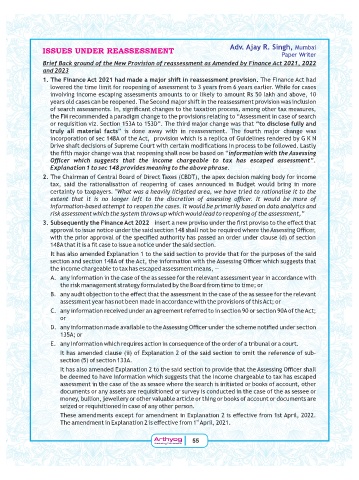

ISSUES UNDER REASSESSMENT Adv. Ajay R. Singh, !

& 7

Brief Back ground of the New Provision of reassessment as Amended by Finance Act 2021, 2022

and 2023

1. The Finance Act 2021 had made a major shift in reassessment provision. < +

1 ! ! . & % . ! - . ! R 7 .

" " % ! & % ! ! ! ,$ " $

& ! @ . ! & " 1

. ! ( % ? % / & ! % / !

< !! & %! % & " % O+ ! .

: " 2 ,-+ ,-AP ! @ % 1 “to disclose fully and

truly all material factsP 1 1 ! . ! @ % 1

& . #+ . + & " 1 & . 4 4 L

A " . . & ! ) 1 ! ? & . 1 0

?. ! @ % 1 & % 1 Oinformation with the Assessing

Officer which suggests that the income chargeable to tax has escaped assessment”.

Explanation 1 to sec 148 provides meaning to the above phrase.

2. ) ! . ) . A / ') A * & / ! % . !

/ . & % . % 1 % !

/& NWhat was a heavily litigated area, we have tried to rationalise it to the

extent that it is no longer left to the discretion of assessing officer. It would be more of

information-based attempt to reopen the cases. It would be primarily based on data analytics and

risk assessment which the system throws up which would lead to reopening of the assessment,”

3. Subsequently the Finance Act 2022 1 & " ? & " D

&& " # : 1 + % EF

1 & && " . & ? & ' * .

#+ ?

( ! 9/& & " . & & .

#+ . + . ! 1 + % EF 1 %%

! % / & ! ! \

+ . ! . . " ! 1

! % ! % . ! . ! ! ! U

@ D ! . . "

! ! 1 & " . + U

) . ! " % ! . $ $+ . + U

A . ! ! " + % EF ! ?

-,+U

9 . ! 1 : : . .

( ! ' * . 9/& = . ! . . ;

',* . --+

( ! 9/& = & " + % EF

! " . ! 1 %% ! % / &

! . 1 .

! : " .

! @ 1 " % . !

2 : . &

! ! / & . ! ! 9/& = D " . ! +& =$==

! ! 9/& = D " . ! +& =$=

y

y

th

th

og

Ar

Ar th y og 55

Arthyogog

Ar

Illuminating Tax Horizons

Illuminating Tax Horizons

Illuminating Tax Horizons

Illuminating Tax Horizons