Page 14 - Grade 10 C.Math

P. 14

PsfO 2 s/ / d'b|f ljlgdo

(Tax and Money Exchange)

2.0 k'g/fjnf]sg (Review)

Curriculum Development Centre

tn lbOPsf k|Zgx¿sf af/]df ;d"xdf 5nkmn ug'{xf];\ / ;fd"lxs lgisif{ kTtf nufO{ sIffsf]7fdf

k|:t't ug'{xf];\ M

-s_ slt ?lkofFsf] 15% s/ lt/]kl5 hDdf ?=5950 k|fKt x'G5 xf]nf <

-v_ s'g} ;fdfg ? x df lsg]/ 10% gfkmf u/L ?= 12000 df las|L ul/of] eg] x sf] dfg

slt xf]nf <

-u_ Pp6f ;fdfgsf] j|mo d"No ?=2500 lyof] . Jofkf/Ln] nfdf] ;do;Dd pSt ;fdfg k;ndf

afFsL /x]sfn] 5% gf]S;fg ;x]/ klg laj|mL ug]{ lg0f{o u¥of] eg] o;sf] ljj|mo

d"No slt xf]nf <

-3_ cf:yf ;xsf/L ;+:yfn] cfˆgf ;b:ox¿nfO{ pknAw ;]o/x¿sf] 19% nfef+z ljt/0f ubf{

/ljgn] ?=15,200 k|fKt u/] eg] pgsf] hDdf ?= 100 a/fa/sf] slt lsTtf ;]o/ /x]5 <

;a} ;d"xn] Ps cfk;df k[i7kf]if0f cfbfg k|bfg ug'{xf];\ / ;a}sf] ;femf lgisif{ lgsfNg'xf];\ . dfly

plNnlvt ljleGg ljifox¿sf] af/]df xfdLn] cluNnf sIffx¿df cWoog ul/;s]sf 5f}F . ca

xfdL d"No clej[b\lw s/ / d'b|f ljlgdosf af/]df cWoog ub{5f}F .

2.1 d"No clej[b\lw s/ (Value Added Tax)

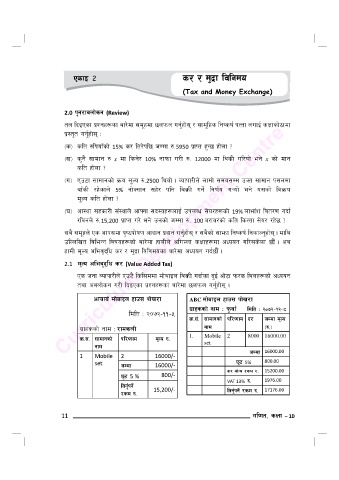

Ps hgf Jofkf/Ln] Pp6} lsl;ddf df]afOn laj|mL ubf{sf b'O{ cf]6f km/s lanx¿sf] cWoog

tyf cjnf]sg u/L lbOPsf k|Zgx¿sf af/]df 5nkmn ug'{xf];\ .

cfrfo{ df]afOn xfp; kf]v/f ABC df]afOn xfp; kf]v/f

u|fxssf] gfd M k'mjf{ ldlt M @)&@–!@–*

ldlt M @)&@–!!–%

j|m=;+= ;fdfgsf] kl/0ffd b/ hDdf d"No

u|fxssf] gfd : /fdsnL gfd -?=_

1. Mobile 2 8000 16000.00

j|m=;= ;fdfgsf] kl/0ffd d"No ?=

set

gfd

1 Mobile 2 16000/- hDdf 16000.00

set hDdf 16000/- 5'6 5% 800.00

s/ of]Uo /sd ?= 15200.00

5'6 5 % 800/-

VAT 13% ?= 1976.00

ltg'{kg]{ 15,200/- 17176.00

/sd ?= ltg'{kg]{ /sd ?=

11 ul0ft, sIff – 10