Page 89 - Charles Calhoun Book Rich As You Want To Be

P. 89

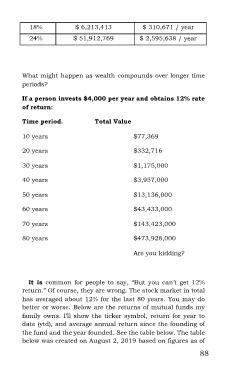

18% $ 6,213,413 $ 310,671 / year

24% $ 51,912,769 $ 2,595,638 / year

What might happen as wealth compounds over longer time

periods?

If a person invests $4,000 per year and obtains 12% rate

of return:

Time period. Total Value

10 years $77,369

20 years $332,716

30 years $1,175,000

40 years $3,957,000

50 years $13,136,000

60 years $43,433,000

70 years $143,423,000

80 years $473,928,000

Are you kidding?

It is common for people to say, “But you can’t get 12%

return.” Of course, they are wrong. The stock market in total

has averaged about 12% for the last 80 years. You may do

better or worse. Below are the returns of mutual funds my

family owns. I’ll show the ticker symbol, return for year to

date (ytd), and average annual return since the founding of

the fund and the year founded. See the table below. The table

below was created on August 2, 2019 based on figures as of

88