Page 31 -

P. 31

Appendix 3

Terms

EEV European embedded value

SIPPs: self-invested personal pensions (SIPPs).

A SIPP is a tax efficient pensions account where you can hold

investments in shares, funds and cash (thus sheltering them

from tax within the account); with the added advantage of tax

relief on your contributions.

The SIPP market now exceeds £50 billion and is expected to

grow even further with the ability to self-invest protected rights.

A SIPP is a self-invested personal pension. It gives you

complete control over your pension savings and where they are

invested. SIPPs are sometimes referred to as wrappers,

because they can hold a range of pension investments tax free,

including cash. Despite the name, you don't have to select the

investments yourself – you can pay someone else to do it for

you.

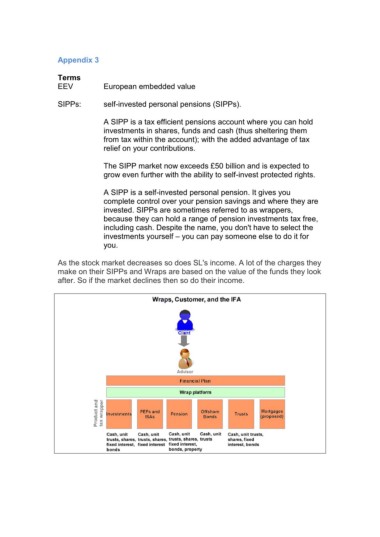

As the stock market decreases so does SL's income. A lot of the charges they

make on their SIPPs and Wraps are based on the value of the funds they look

after. So if the market declines then so do their income.