Page 43 - 2022 Annual Report 2022 FINAL

P. 43

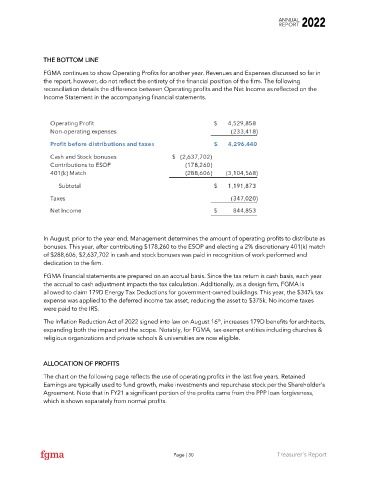

THE BOTTOM LINE

FGMA continues to show Operating Profits for another year. Revenues and Expenses discussed so far in

the report, however, do not reflect the entirety of the financial position of the firm. The following

reconciliation details the difference between Operating profits and the Net Income as reflected on the

Income Statement in the accompanying financial statements.

In August, prior to the year end, Management determines the amount of operating profits to distribute as

bonuses. This year, after contributing $178,260 to the ESOP and electing a 2% discretionary 401(k) match

of $288,606, $2,637,702 in cash and stock bonuses was paid in recognition of work performed and

dedication to the firm.

FGMA financial statements are prepared on an accrual basis. Since the tax return is cash basis, each year

the accrual to cash adjustment impacts the tax calculation. Additionally, as a design firm, FGMA is

allowed to claim 179D Energy Tax Deductions for government-owned buildings. This year, the $347k tax

expense was applied to the deferred income tax asset, reducing the asset to $375k. No income taxes

were paid to the IRS.

th

The Inflation Reduction Act of 2022 signed into law on August 16 , increases 179D benefits for architects,

expanding both the impact and the scope. Notably, for FGMA, tax-exempt entities including churches &

religious organizations and private schools & universities are now eligible.

ALLOCATION OF PROFITS

The chart on the following page reflects the use of operating profits in the last five years. Retained

Earnings are typically used to fund growth, make investments and repurchase stock per the Shareholder’s

Agreement. Note that in FY21 a significant portion of the profits came from the PPP loan forgiveness,

which is shown separately from normal profits.

Page | 30 Treasurer’s Report