Page 46 - UKZN Foundation AR 2024

P. 46

UNIVERSITY OF KWAZULU-NATAL FOUNDATION TRUST Trust Deed number: IT 589/2003

NOTES TO THE FINANCIAL STATEMENTS (continued)

for the year ended 31December 2024

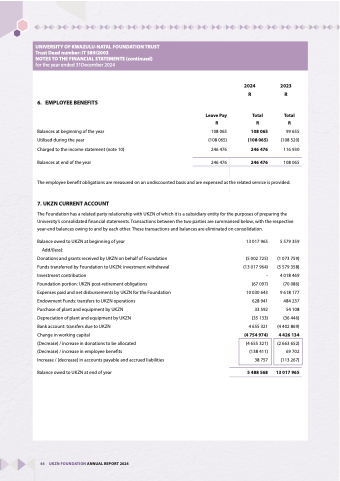

6. EMPLOYEE BENEFITS

Balances at beginning of the year

Utilised during the year

Charged to the income statement (note 10)

Balances at end of the year

246 476

2024

R

Total

R

108 065

(108 065)

246 476

2023

R

246 476

The employee benefit obligations are measured on an undiscounted basis and are expensed as the related service is provided.

7. UKZN CURRENT ACCOUNT

The Foundation has a related party relationship with UKZN of which it is a subsidiary entity for the purposes of preparing the University’s consolidated financial statements. Transactions between the two parties are summarised below, with the respective year-end balances owing to and by each other. These transactions and balances are eliminated on consolidation.

Balance owed to UKZN at beginning of year

Add/(less):

Donations and grants received by UKZN on behalf of Foundation

Funds transferred by Foundation to UKZN: investment withdrawal

Investment contribution

Foundation portion: UKZN post-retirement obligations

Expenses paid and net disbursements by UKZN for the Foundation

Endowment Funds: transfers to UKZN operations

Purchase of plant and equipment by UKZN

Depreciation of plant and equipment by UKZN

Bank account: transfers due to UKZN

Change in working capital

(Decrease) / increase in donations to be allocated

(Decrease) / increase in employee benefits

Increase / (decrease) in accounts payable and accrued liabilities

Balance owed to UKZN at end of year

(4 655 321) (138 411) 38 757

(2 663 652) 69 702 (113 267)

13 017 965

Leave Pay Total RR

108 065 (108 065)

246 476

99 655 (108 520)

116 930 108 065

13 017 965

(5 002 725) (13 017 964) - (67 097) 10 030 643 628 941 33 592 (35 133) 4 655 321 (4 754 974)

5 488 568

5 579 359

(1 073 759) (5 579 358) 4 018 469 (70 086) 9 618 177 484 237 54 108 (36 446) (4 402 869) 4 426 134

44 UKZN FOUNDATION ANNUAL REPORT 2024