Page 48 - UKZN Foundation AR 2024

P. 48

UNIVERSITY OF KWAZULU-NATAL FOUNDATION TRUST Trust Deed number: IT 589/2003

NOTES TO THE FINANCIAL STATEMENTS (continued)

for the year ended 31December 2024

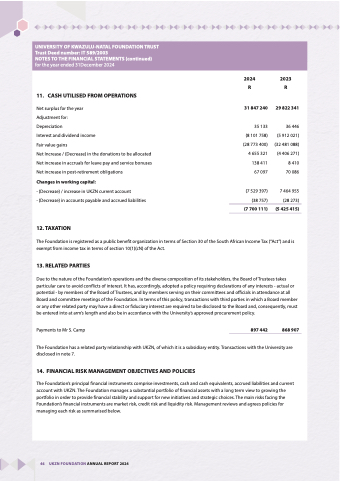

11. CASH UTILISED FROM OPERATIONS

Net surplus for the year

Adjustment for:

Depreciation

Interest and dividend income

Fair value gains

Net Increase / (Decrease) in the donations to be allocated

Net increase in accruals for leave pay and service bonuses

Net increase in post-retirement obligations

Changes in working capital:

- (Decrease) / increase in UKZN current account

- (Decrease) in accounts payable and accrued liabilities

12. TAXATION

The Foundation is registered as a public benefit organization in terms of Section 30 of the South African Income Tax (“Act”) and is exempt from income tax in terms of section 10(1)(cN) of the Act.

13. RELATED PARTIES

Due to the nature of the Foundation’s operations and the diverse composition of its stakeholders, the Board of Trustees takes particular care to avoid conflicts of interest. It has, accordingly, adopted a policy requiring declarations of any interests - actual or potential - by members of the Board of Trustees, and by members serving on their committees and officials in attendance at all Board and committee meetings of the Foundation. In terms of this policy, transactions with third parties in which a Board member or any other related party may have a direct or fiduciary interest are required to be disclosed to the Board and, consequently, must be entered into at arm’s length and also be in accordance with the University’s approved procurement policy.

Payments to Mr S. Camp

The Foundation has a related party relationship with UKZN, of which it is a subsidiary entity. Transactions with the University are disclosed in note 7.

14. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES

The Foundation’s principal financial instruments comprise investments, cash and cash equivalents, accrued liabilities and current account with UKZN. The Foundation manages a substantial portfolio of financial assets with a long term view to growing the portfolio in order to provide financial stability and support for new initiatives and strategic choices. The main risks facing the Foundation’s financial instruments are market risk, credit risk and liquidity risk. Management reviews and agrees policies for managing each risk as summarised below.

2024

R

2023

R

(38 757)

(7 700 111)

31 847 240

35 133 (8 101 758) (28 773 400) 4 655 321 138 411 67 097

(7 529 397)

29 822 341

36 446 (5 912 021) (32 481 088) (4 406 271) 8 410 70 086

7 464 955 (28 273) (5 425 415)

897 442

868 907

46 UKZN FOUNDATION ANNUAL REPORT 2024