Page 49 - UKZN Foundation AR 2024

P. 49

UNIVERSITY OF KWAZULU-NATAL FOUNDATION TRUST Trust Deed number: IT 589/2003

NOTES TO THE FINANCIAL STATEMENTS (continued)

for the year ended 31December 2024

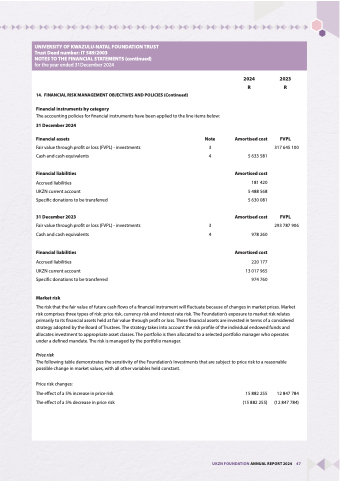

14. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)

Financial instruments by category

The accounting policies for financial instruments have been applied to the line items below:

31 December 2024

Financial assets

Fair value through profit or loss (FVPL) - investments

Cash and cash equivalents

Financial liabilities

Accrued liabilities

UKZN current account

Specific donations to be transferred

31 December 2023

Fair value through profit or loss (FVPL) - investments

Cash and cash equivalents

Financial liabilities

Accrued liabilities

UKZN current account

Specific donations to be transferred

Market risk

The risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes in market prices. Market risk comprises three types of risk: price risk, currency risk and interest rate risk. The Foundation’s exposure to market risk relates primarily to its financial assets held at fair value through profit or loss. These financial assets are invested in terms of a considered strategy adopted by the Board of Trustees. The strategy takes into account the risk profile of the individual endowed funds and allocates investment to appropriate asset classes. The portfolio is then allocated to a selected portfolio manager who operates under a defined mandate. The risk is managed by the portfolio manager.

Price risk

The following table demonstrates the sensitivity of the Foundation’s Investments that are subject to price risk to a reasonable possible change in market values, with all other variables held constant.

Price risk changes:

The effect of a 5% increase in price risk

The effect of a 5% decrease in price risk

2024

R

2023

R

5 488 568

5 630 081

Amortised cost

Note

3 4

3 4

Amortised cost

FVPL

317 645 100 5 633 581

Amortised cost

181 420

FVPL

Amortised cost

220 177 13 017 965 974 760

293 787 906 978 260

15 882 255 (15 882 255)

12 847 784 (12 847 784)

UKZN FOUNDATION ANNUAL REPORT 2024 47