Page 109 - KZN Film Annual Report 2023/2024

P. 109

KWAZULU-NATAL FILM COMMISSION

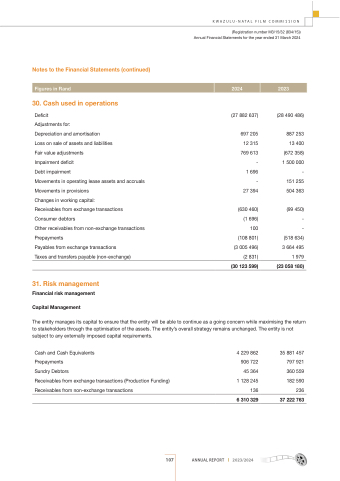

Notes to the Financial Statements (continued)

30. Cash used in operations

Deficit

Adjustments for:

Depreciation and amortisation

Loss on sale of assets and liabilities

Fair value adjustments

Impairment deficit

Debt impairment

Movements in operating lease assets and accruals Movements in provisions

Changes in working capital:

Receivables from exchange transactions Consumer debtors

Other receivables from non-exchange transactions Prepayments

Payables from exchange transactions

Taxes and transfers payable (non-exchange)

31. Risk management

Financial risk management

Capital Management

(27 882 637)

697 205 12 315 769 613 - 1 696 - 27 394

(630 460) (1 696) 100 (108 801) (3 005 496) (2 831) (30 123 599)

(28 490 486)

887 253 13 400 (672 358) 1 500 000 - 151 255 504 363

(99 450) - - (518 634) 3 664 495 1 979 (23 058 180)

(Registration number M3/15/32 (834/15)) Annual Financial Statements for the year ended 31 March 2024

Figures in Rand

2024

2023

The entity manages its capital to ensure that the entity will be able to continue as a going concern while maximising the return to stakeholders through the optimisation of the assets. The entity’s overall strategy remains unchanged. The entity is not subject to any externally imposed capital requirements.

Cash and Cash Equivalents

Prepayments

Sundry Debtors

Receivables from exchange transactions (Production Funding) Receivables from non-exchange transactions

4 229 862 906 722 45 364 1 128 245 136 6 310 329

35 881 457 797 921 360 559 182 590 236 37 222 763

107

ANNUAL REPORT

2023/2024