Page 111 - KZN Film Annual Report 2023/2024

P. 111

KWAZULU-NATAL FILM COMMISSION

Notes to the Financial Statements (continued)

31. Risk management (continued)

Market risk

Interest rate risk

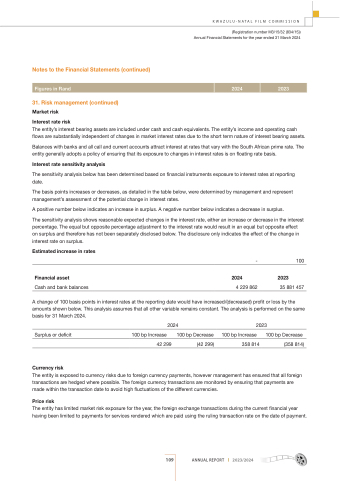

Estimated increase in rates

-

Cash and bank balances 4 229 862

100

2023

35 881 457

(Registration number M3/15/32 (834/15)) Annual Financial Statements for the year ended 31 March 2024

Figures in Rand

2024

2023

The entity’s interest bearing assets are included under cash and cash equivalents. The entity’s income and operating cash flows are substantially independent of changes in market interest rates due to the short term nature of interest bearing assets.

Balances with banks and all call and current accounts attract interest at rates that vary with the South African prime rate. The entity generally adopts a policy of ensuring that its exposure to changes in interest rates is on floating rate basis.

Interest rate sensitivity analysis

The sensitivity analysis below has been determined based on financial instruments exposure to interest rates at reporting date.

The basis points increases or decreases, as detailed in the table below, were determined by management and represent management’s assessment of the potential change in interest rates.

A positive number below indicates an increase in surplus. A negative number below indicates a decrease in surplus.

The sensitivity analysis shows reasonable expected changes in the interest rate, either an increase or decrease in the interest percentage. The equal but opposite percentage adjustment to the interest rate would result in an equal but opposite effect on surplus and therefore has not been separately disclosed below. The disclosure only indicates the effect of the change in interest rate on surplus.

Financial asset 2024

A change of 100 basis points in interest rates at the reporting date would have increased/(decreased) profit or loss by the amounts shown below. This analysis assumes that all other variable remains constant. The analysis is performed on the same basis for 31 March 2024.

2024

Surplus or deficit 100 bp Increase 100 bp Decrease 42 299 (42 299)

Currency risk

2023

100 bp Increase 100 bp Decrease

358 814 (358 814)

The entity is exposed to currency risks due to foreign currency payments, however management has ensured that all foreign transactions are hedged where possible. The foreign currency transactions are monitored by ensuring that payments are made within the transaction date to avoid high fluctuations of the different currencies.

Price risk

The entity has limited market risk exposure for the year, the foreign exchange transactions during the current financial year having been limited to payments for services rendered which are paid using the ruling transaction rate on the date of payment.

109 ANNUAL REPORT 2023/2024