Page 50 - CAO 25th Ann Coffee Table Book

P. 50

days, most complaints raised during the first operational year were successfully addressed.

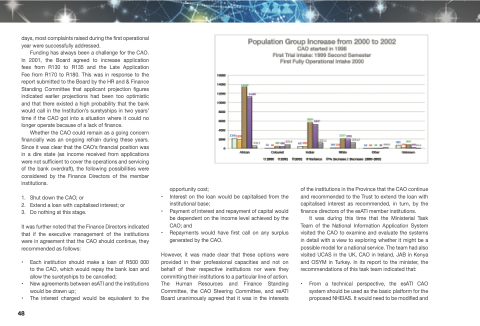

Funding has always been a challenge for the CAO. In 2001, the Board agreed to increase application fees from R130 to R135 and the Late Application Fee from R170 to R180. This was in response to the report submitted to the Board by the HR and & Finance Standing Committee that applicant projection figures indicated earlier projections had been too optimistic and that there existed a high probability that the bank would call in the Institution’s suretyships in two years’ time if the CAO got into a situation where it could no longer operate because of a lack of finance.

Whether the CAO could remain as a going concern financially was an ongoing refrain during these years. Since it was clear that the CAO’s financial position was in a dire state (as income received from applications were not sufficient to cover the operations and servicing of the bank overdraft), the following possibilities were considered by the Finance Directors of the member institutions.

1. Shut down the CAO; or

2. Extend a loan with capitalised interest; or

3. Do nothing at this stage.

It was further noted that the Finance Directors indicated that if the executive management of the institutions were in agreement that the CAO should continue, they recommended as follows:

• Each institution should make a loan of R500 000 to the CAO, which would repay the bank loan and allow the suretyships to be cancelled;

• New agreements between esATI and the institutions would be drawn up;

• The interest charged would be equivalent to the

opportunity cost;

• Interest on the loan would be capitalised from the

institutional base;

• Payment of interest and repayment of capital would

be dependent on the income level achieved by the

CAO; and

• Repayments would have first call on any surplus

generated by the CAO.

However, it was made clear that these options were provided in their professional capacities and not on behalf of their respective institutions nor were they committing their institutions to a particular line of action. The Human Resources and Finance Standing Committee, the CAO Steering Committee, and esATI Board unanimously agreed that it was in the interests

of the institutions in the Province that the CAO continue and recommended to the Trust to extend the loan with capitalised interest as recommended, in turn, by the finance directors of the esATI member institutions.

It was during this time that the Ministerial Task Team of the National Information Application System visited the CAO to examine and evaluate the systems in detail with a view to exploring whether it might be a possible model for a national service. The team had also visited UCAS in the UK, CAO in Ireland, JAB in Kenya and OSYM in Turkey. In its report to the minister, the recommendations of this task team indicated that:

• From a technical perspective, the esATI CAO system should be used as the basic platform for the proposed NHEIAS. It would need to be modified and

48