Page 3 - FieldSyncSimplified10-8

P. 3

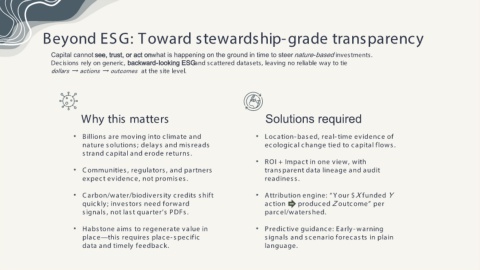

Beyond ESG: Toward stewardship-grade transparency

Capital cannot see, trust, or act onwhat is happening on the ground in time to steer nature-based investments.

Decisions rely on generic, backward-looking ESGand scattered datasets, leaving no reliable way to tie

dollars → actions → outcomes at the site level.

Why this matters Solutions required

• Billions are moving into climate and • Location-based, real- time evidence of

nature solutions; delays and misreads ecological change tied to capital flows.

strand capital and erode returns.

• ROI + Impact in one view, with

• C ommunities, regulators, and partners transparent data lineage and audit

expect evidence, not promises. readiness.

• C arbon/water/biodiversity credits shift • Attribution engine: “ Y our $X funded Y

quickly; investors need forward action produced Z outcome” per

signals, not last quarter’s PDFs. parcel/watershed.

• Habstone aims to regenerate value in • Predictive guidance: Early- warning

place—this requires place- specific signals and scenario forecasts in plain

data and timely feedback. language.