Page 12 - Prestige Brochures & Enrollment Packet

P. 12

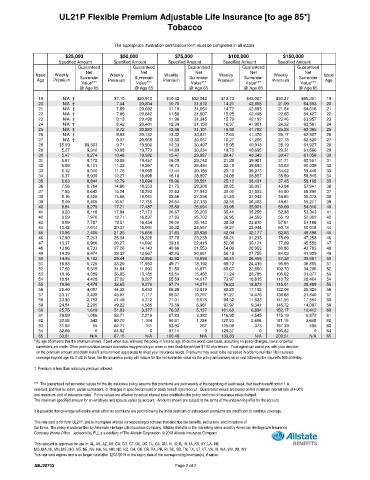

UL21P Flexible Premium Adjustable Life Insurance [to age 85*]

Tobacco

The appropriate illustration certification form must be completed in all states.

$25,000 $50,000 $75,000 $100,000 $150,000

Specified Amount Specified Amount Specified Amount Specified Amount Specified Amount

Guaranteed Guaranteed Guaranteed Guaranteed Guaranteed

Net Net Net Net Net

Issue Weekly Weekly Weekly Weekly Weekly Issue

Surrender Surrender Surrender Surrender Surrender

Age Premium Premium Premium Premium Premium Age

Value*** Value*** Value*** Value*** Value***

@ Age 65 @ Age 65 @ Age 65 @ Age 65 @ Age 65

19 N/A † $7.10 $20,910 $10.42 $32,042 $13.73 $43,087 $20.37 $65,351 19

20 N/A † 7.34 20,804 10.78 31,872 14.21 42,858 21.09 64,993 20

21 N/A † 7.59 20,692 11.15 31,654 14.72 42,693 21.84 64,616 21

22 N/A † 7.86 20,642 11.56 31,607 15.25 42,498 22.65 64,427 22

23 N/A † 8.13 20,498 11.96 31,345 15.79 42,192 23.46 63,957 23

24 N/A † 8.42 20,401 12.39 31,158 16.37 41,981 24.32 63,561 24

25 N/A † 8.72 20,283 12.86 31,101 16.98 41,792 25.25 63,365 25

26 N/A † 9.03 20,132 13.32 30,831 17.60 41,470 26.17 62,807 26

27 N/A † 9.37 20,068 13.82 30,667 18.27 41,266 27.18 62,520 27

28 $5.09 $9,393 9.71 19,900 14.33 30,407 18.95 40,913 28.19 61,927 28

29 5.27 9,312 10.08 19,773 14.89 30,234 19.70 40,695 29.31 61,566 29

30 5.47 9,274 10.46 19,582 15.47 29,987 20.47 40,343 30.47 61,056 30

31 5.67 9,172 10.88 19,457 16.09 29,742 21.29 39,981 31.71 60,551 31

32 5.89 9,101 11.32 19,297 16.75 29,494 22.18 39,690 33.03 60,039 32

33 6.12 9,010 11.78 19,098 17.44 29,185 23.10 39,273 34.42 59,448 33

34 6.37 8,939 12.27 18,898 18.18 28,897 24.08 38,857 35.89 58,815 34

35 6.63 8,844 12.79 18,694 18.96 28,581 25.12 38,431 37.45 58,168 35

36 7.56 8,764 14.66 18,553 21.75 28,308 28.85 38,097 43.04 57,641 36

37 7.85 8,642 15.24 18,293 22.63 27,943 30.02 37,593 44.80 56,894 37

38 8.16 8,525 15.86 18,041 23.56 27,556 31.25 37,042 46.65 56,073 38

39 8.49 8,405 16.51 17,755 24.54 27,133 32.56 36,483 48.61 55,211 39

40 8.84 8,279 17.21 17,487 25.58 26,694 33.95 35,901 50.69 54,316 40

41 9.20 8,118 17.94 17,173 26.67 26,203 35.41 35,258 52.88 53,343 41

42 9.59 7,970 18.71 16,837 27.83 25,703 36.95 34,569 55.19 52,302 42

43 9.99 7,787 19.51 16,454 29.04 25,143 38.56 33,810 57.61 51,166 43

44 10.42 7,614 20.37 16,091 30.32 24,567 40.27 33,044 60.18 50,018 44

45 10.86 7,405 21.25 15,656 31.65 23,926 42.04 32,177 62.83 48,698 45

46 12.90 7,213 25.34 15,226 37.78 23,238 50.21 31,233 75.09 47,258 46

47 13.37 6,986 26.27 14,692 39.18 22,415 52.08 30,121 77.89 45,550 47

48 13.86 6,733 27.26 14,143 40.66 21,553 54.06 28,963 80.86 43,783 48

49 14.39 6,474 28.32 13,567 42.25 20,661 56.18 27,755 84.03 41,929 49

50 14.95 6,193 29.44 12,952 43.92 19,698 58.41 26,456 87.38 39,961 50

51 16.88 5,725 33.29 11,953 49.71 18,192 66.12 24,419 98.95 36,885 51

52 17.50 5,315 34.54 11,093 51.58 16,871 68.62 22,650 102.70 34,206 52

53 18.16 4,889 35.85 10,185 53.54 15,480 71.24 20,785 106.62 31,377 53

54 18.84 4,428 37.22 9,227 55.59 14,017 73.97 18,815 110.72 28,404 54

55 19.56 4,478 38.65 9,276 57.74 14,074 76.83 18,872 115.01 28,469 55

56 22.40 4,087 44.33 8,453 66.26 12,819 88.20 17,192 132.06 25,925 56

57 23.17 3,438 45.87 7,117 68.57 10,797 91.27 14,476 136.68 21,840 57

58 23.98 2,753 47.49 5,712 71.01 8,675 94.52 11,633 141.55 17,554 58

59 24.84 2,205 49.22 4,585 73.59 6,961 97.97 9,341 146.72 14,097 59

60 25.75 1,619 51.03 3,377 76.32 5,137 101.60 6,894 152.17 10,412 60

61 29.59 1,056 58.71 2,219 87.83 3,382 116.95 4,545 175.19 6,872 61

62 30.58 542 60.70 1,164 90.81 1,784 120.93 2,406 181.16 3,648 62

63 31.62 55 62.77 161 93.93 267 125.08 373 187.39 585 63

64 32.69 0 64.92 0 97.14 0 129.37 0 193.82 0 64

65 33.81 N/A 67.15 N/A 100.49 N/A 133.83 N/A 200.51 N/A 65

* [to age 85] means that the premium shown, if paid when due, will keep the policy in force to age 85 on the worst-case basis, assuming no policy changes, loans, or partial

surrenders are made. Other premium/face amount scenarios may provide you more or less death benefit per $1.00 of premium. Your agent can assist you with your decision

on the premium amount and death benefit amount most appropriate to meet your insurance needs. Premiums may need to be increased in order to maintain life insurance

coverage beyond age 85. If still in force, the life insurance policy will mature for the net surrender value on the policy anniversary on or next following the insured's 95th birthday.

† Premium is less than minimum premium allowed.

*** The guaranteed net surrender values for the life insurance policy assume that premiums are paid weekly at the beginning of each week, that death benefit option 1 is

selected, and that no loans, partial surrenders, or changes in specified amount or death benefit option occur. Guaranteed values are based on the minimum interest rate of 4.00%

and maximum cost of insurance rates. Policy values are affected by actual interest rates credited to the policy and cost of insurance rates charged.

The maximum specified amount for an employee and spouse varies by account. Amounts shown are subject to the terms of the underwriting offer for the account.

It is possible that coverage will expire when either no premiums are paid following the initial premium or subsequent premiums are insufficient to continue coverage.

This rate card is for form UL21P, and is incomplete without corresponding brochures that describe the benefits, exclusions, and limitations of

the forms. The policy is underwritten by American Heritage Life Insurance Company. Allstate Benefits is the marketing name used by American Heritage Life Insurance

Company (Home Office: Jacksonville, FL), a subsidiary of The Allstate Corporation. © 2018 Allstate Insurance Company

This ratecard is approved for use in: AL, AK, AZ, AR, CA, CO, CT, DE, DC, FL, GA, GU, HI, ID, IL, IN, IA, KS, KY, LA, ME

MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VT, VA, VI, WA, WV, WI, WY

This rate card expires and is no longer valid after 12/31/2019 or the expiry date of the corresponding brochure(s), if earlier.

ABJ20733 Page 2 of 2