Page 25 - E. Cohen & Co. Allstate Benefits Flipbook 2020

P. 25

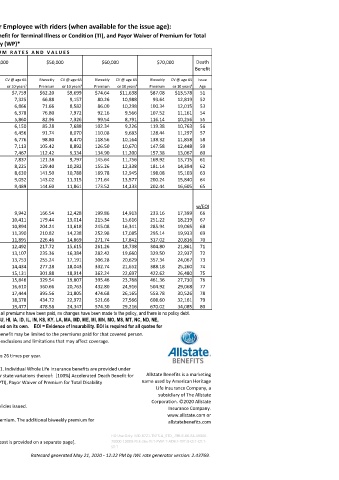

Allstate Benefits Individual Whole Life Insurance (IWL) for Employee with riders (when available for the issue age):

[100%] Accelerated Death Benefit for Chronic Illness (CI)†, Accelerated Death Benefit for Terminal Illness or Condition (TI), and Payor Waiver of Premium for Total

Disability (WP)*

N O N - T O B A C C O P R E M I U M R A T E S A N D V A L U E S

Death $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 Death

Benefit Benefit

Issue Biweekly CV @ age 65 Biweekly CV @ age 65 Biweekly CV @ age 65 Biweekly CV @ age 65 Biweekly CV @ age 65 Biweekly CV @ age 65 Biweekly CV @ age 65 Issue

Age Premium or 10 years¹ Premium or 10 years¹ Premium or 10 years¹ Premium or 10 years¹ Premium or 10 years¹ Premium or 10 years¹ Premium or 10 years¹ Age

51 $12.44 $1,940 $24.88 $3,879 $37.32 $5,819 $49.76 $7,759 $62.20 $9,699 $74.64 $11,638 $87.08 $13,578 51

52 13.38 1,831 26.76 3,663 40.14 5,494 53.50 7,325 66.88 9,157 80.26 10,988 93.64 12,819 52

53 14.34 1,716 28.68 3,433 43.00 5,149 57.34 6,866 71.66 8,582 86.00 10,298 100.34 12,015 53

54 15.38 1,594 30.72 3,189 46.08 4,783 61.44 6,378 76.80 7,972 92.16 9,566 107.52 11,161 54

55 16.60 1,465 33.18 2,930 49.78 4,395 66.36 5,860 82.96 7,326 99.54 8,791 116.14 10,256 55

56 17.06 1,538 34.12 3,075 51.18 4,613 68.22 6,150 85.28 7,688 102.34 9,226 119.38 10,763 56

57 18.36 1,614 36.70 3,228 55.04 4,842 73.40 6,456 91.74 8,070 110.08 9,683 128.44 11,297 57

58 19.76 1,694 39.52 3,388 59.28 5,082 79.04 6,776 98.80 8,470 118.56 10,164 138.32 11,858 58

59 21.08 1,778 42.16 3,557 63.26 5,335 84.34 7,113 105.42 8,892 126.50 10,670 147.58 12,448 59

60 22.48 1,867 44.98 3,733 67.46 5,600 89.92 7,467 112.42 9,334 134.90 11,200 157.38 13,067 60

61 24.28 1,959 48.56 3,919 72.82 5,878 97.10 7,837 121.38 9,797 145.64 11,756 169.92 13,715 61

62 25.88 2,056 51.76 4,113 77.64 6,169 103.52 8,225 129.40 10,282 155.26 12,338 181.14 14,394 62

63 28.30 2,158 56.60 4,315 84.90 6,473 113.20 8,630 141.50 10,788 169.78 12,945 198.08 15,103 63

64 28.62 2,263 57.22 4,526 85.82 6,789 114.42 9,052 143.02 11,315 171.64 13,577 200.24 15,840 64

65 28.92 2,372 57.84 4,744 86.76 7,117 115.68 9,489 144.60 11,861 173.52 14,233 202.44 16,605 65

w/EOI w/EOI

66 33.32 2,486 66.62 4,971 99.94 7,457 133.24 9,942 166.54 12,428 199.86 14,913 233.16 17,399 66

67 35.90 2,603 71.78 5,205 107.68 7,808 143.56 10,411 179.44 13,014 215.34 15,616 251.22 18,219 67

68 40.86 2,724 81.70 5,447 122.54 8,171 163.40 10,894 204.24 13,618 245.08 16,341 285.94 19,065 68

69 42.16 2,848 84.34 5,695 126.50 8,543 168.66 11,390 210.82 14,238 252.98 17,085 295.14 19,933 69

70 45.30 2,974 90.58 5,947 135.88 8,921 181.16 11,895 226.46 14,869 271.74 17,842 317.02 20,816 70

71 43.54 3,123 87.10 6,246 130.64 9,369 174.18 12,492 217.72 15,615 261.26 18,738 304.80 21,861 71

72 47.08 3,277 94.14 6,553 141.22 9,830 188.28 13,107 235.36 16,384 282.42 19,660 329.50 22,937 72

73 51.06 3,438 102.10 6,876 153.14 10,315 204.20 13,753 255.24 17,191 306.28 20,629 357.34 24,067 73

74 55.46 3,609 110.92 7,217 166.36 10,826 221.82 14,434 277.28 18,043 332.74 21,652 388.18 25,260 74

75 60.38 3,783 120.76 7,566 181.12 11,348 241.50 15,131 301.88 18,914 362.24 22,697 422.62 26,480 75

76 65.92 3,961 131.82 7,923 197.74 11,884 263.64 15,846 329.54 19,807 395.46 23,768 461.36 27,730 76

77 72.14 4,153 144.28 8,305 216.40 12,458 288.52 16,610 360.66 20,763 432.80 24,916 504.92 29,068 77

78 79.12 4,361 158.24 8,722 237.34 13,083 316.46 17,444 395.56 21,805 474.68 26,165 553.78 30,526 78

79 86.96 4,594 173.90 9,189 260.84 13,783 347.78 18,378 434.72 22,972 521.66 27,566 608.60 32,161 79

80 95.72 4,869 191.44 9,739 287.16 14,608 382.86 19,477 478.58 24,347 574.30 29,216 670.02 34,085 80

¹ CV @ age 65 or 10 years - Cash Value shown is at attained age 65 or the end of year 10 if later, and assumes all premiums have been paid, no changes have been made to the policy, and there is no policy debt.

This rate insert is for use with materials for applications taken in AK, AL, AR, AZ, CO, CT, DC, DE, GA, GU, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, MT, NC, ND, NE,

NH, NJ, NM, NV, OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA, VI, VT, WA, WI, WY, and is not to be used on its own. EOI = Evidence of Insurability. EOI is required for all quotes for

issue ages 66-80.

EXCLUSIONS AND LIMITATIONS: Suicide Exclusion - If a covered person commits suicide, the death benefit may be limited to the premiums paid for that covered person.

Other Exclusions and Limitations - The policy and riders (if included) have other elimination periods, exclusions and limitations that may affect coverage.

Please refer to the policy for details.

Rates shown are based on Tobacco/Non-tobacco, Issue Age Specific rating structure. BIWEEKLY means 26 times per year.

This information is valid as long as information remains current, but in no event later than 12/31/2021. Individual Whole Life Insurance benefits are provided under

form ICC18IWLP, or state variations thereof. Rider benefits are provided under the following forms, or state variations thereof: [100%] Accelerated Death Benefit for Allstate Benefits is a marketing

Chronic Illness (ICC18IWLPCI), Accelerated Death Benefit for Terminal Illness or Condition (ICC18IWLPTI), Payor Waiver of Premium for Total Disability name used by American Heritage

(ICC18IWLPWP), Children’s Term (ICC18IWLPCT), and Spouse's Level Term (ICC18IWLPST). Life Insurance Company, a

subsidiary of The Allstate

This is underwritten by American Heritage Life Insurance Company (Home Office, Jacksonville, FL).

Corporation. ©2020 Allstate

Details of the insurance, including exclusions, restrictions, and other provisions are included in the policies issued.

Insurance Company.

For additional information, you may contact your Allstate Benefits Representative. www.allstate.com or

The Children's Term (ICC18IWLPCT)‡ rider may be added to the Employee's policy for an additional premium. The additional biweekly premium for allstatebenefits.com

$10,000 is $2.22 for issue ages 18-55, or $2.10 for issue ages 56-65.

† Issue Ages 18-70 Only for [100%] Accelerated Death Benefit for Chronic Illness (CI). HO Use Only: MD-8721-TNTS-A_STD_-TRUE-60-FA-10000-

‡ Issue Ages 18-65 Only for Children's Term (CT) and Spouse's Level Term (ST) [Spouse's Term add-on cost is provided on a separate page]. 70000-10000-PI:E-26x-TI:T-PWP:T-ADB:F-TYT:0-CI:T-CT:T-

* Issue Ages 18-55 Only for Payor Waiver of Premium for Total Disability (WP). ST:T

Ratecard generated May 21, 2020 - 12:22 PM by IWL rate generator version: 2.43769.

ABJ20743-33333