Page 25 - Andy Goetz Proposal

P. 25

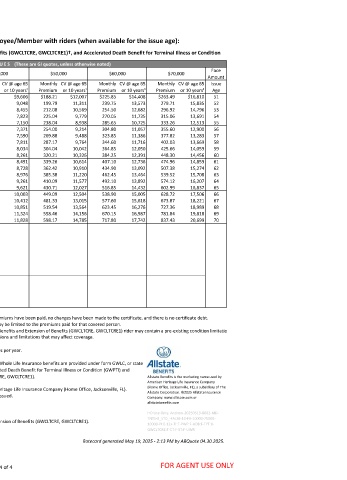

Allstate Benefits Group Whole Life Insurance (GWL) for Employee/Member with riders (when available for the issue age):

Accelerated Death Benefit for Long Term Care with Restoration of Benefits and Extension of Benefits (GWCLTCRE, GWCLTCRE1)†, and Accelerated Death Benefit for Terminal Illness or Condition

T O B A C C O P R E M I U M R A T E S A N D V A L U E S (These are GI quotes, unless otherwise noted)

Face Face

Amount $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 Amount

Issue Monthly CV @ age 65 Monthly CV @ age 65 Monthly CV @ age 65 Monthly CV @ age 65 Monthly CV @ age 65 Monthly CV @ age 65 Monthly CV @ age 65 Issue

Age Premium or 10 years¹ Premium or 10 years¹ Premium or 10 years¹ Premium or 10 years¹ Premium or 10 years¹ Premium or 10 years¹ Premium or 10 years¹ Age

51 $37.64 $2,401 $75.29 $4,803 $112.93 $7,204 $150.56 $9,606 $188.21 $12,007 $225.85 $14,408 $263.49 $16,810 51

52 39.96 2,262 79.91 4,524 119.88 6,786 159.84 9,048 199.79 11,311 239.75 13,573 279.71 15,835 52

53 42.42 2,114 84.83 4,227 127.25 6,341 169.67 8,455 212.08 10,569 254.50 12,682 296.92 14,796 53

54 45.01 1,956 90.01 3,912 135.03 5,867 180.04 7,823 225.04 9,779 270.05 11,735 315.06 13,691 54

55 47.61 1,788 95.21 3,575 142.83 5,363 190.44 7,150 238.04 8,938 285.65 10,725 333.26 12,513 55

56 50.80 1,843 101.60 3,686 152.41 5,528 203.20 7,371 254.00 9,214 304.80 11,057 355.60 12,900 56

57 53.97 1,898 107.95 3,795 161.93 5,693 215.90 7,590 269.88 9,488 323.85 11,386 377.82 13,283 57

58 57.43 1,953 114.87 3,905 172.30 5,858 229.73 7,811 287.17 9,764 344.60 11,716 402.03 13,669 58

59 60.81 2,008 121.62 4,017 182.43 6,025 243.23 8,034 304.04 10,042 364.85 12,050 425.66 14,059 59

60 64.05 2,065 128.08 4,130 192.13 6,196 256.17 8,261 320.21 10,326 384.25 12,391 448.30 14,456 60

61 67.86 2,123 135.70 4,245 203.56 6,368 271.40 8,491 339.26 10,614 407.10 12,736 474.96 14,859 61

62 72.48 2,182 144.97 4,364 217.45 6,546 289.93 8,728 362.42 10,910 434.90 13,092 507.38 15,274 62

63 77.07 2,244 154.15 4,488 231.23 6,732 308.30 8,976 385.38 11,220 462.45 13,464 539.52 15,708 63

64 82.02 2,315 164.03 4,631 246.06 6,946 328.07 9,261 410.09 11,577 492.10 13,892 574.12 16,207 64

65 86.14 2,405 172.29 4,811 258.43 7,216 344.56 9,621 430.71 12,027 516.85 14,432 602.99 16,837 65

66 89.82 2,501 179.63 5,002 269.46 7,502 359.27 10,003 449.09 12,504 538.90 15,005 628.72 17,506 66

67 96.27 2,603 192.53 5,206 288.80 7,809 385.07 10,412 481.33 13,015 577.60 15,618 673.87 18,221 67

68 103.91 2,713 207.82 5,425 311.73 8,138 415.63 10,851 519.54 13,564 623.45 16,276 727.36 18,989 68

69 111.69 2,831 223.38 5,662 335.08 8,493 446.77 11,324 558.46 14,156 670.15 16,987 781.84 19,818 69

70 119.63 2,957 239.27 5,914 358.90 8,871 478.53 11,828 598.17 14,785 717.80 17,742 837.43 20,699 70

w/EOI Quote Requires EOI Quote Requires EOI Quote Requires EOI Quote Requires EOI Quote Requires EOI Quote Requires EOI Quote Requires EOI w/EOI

71 115.42 3,088 230.83 6,175 346.25 9,263 461.67 12,350 577.08 15,438 692.50 18,526 807.92 21,613 71

72 124.16 3,221 248.32 6,442 372.48 9,663 496.63 12,884 620.79 16,105 744.95 19,326 869.11 22,547 72

73 133.76 3,355 267.52 6,710 401.28 10,065 535.03 13,420 668.79 16,775 802.55 20,130 936.31 23,485 73

74 144.46 3,490 288.92 6,979 433.38 10,469 577.83 13,958 722.29 17,448 866.75 20,937 1,011.21 24,427 74

75 156.43 3,632 312.85 7,263 469.28 10,895 625.70 14,526 782.13 18,158 938.55 21,789 1,094.98 25,421 75

76 169.82 3,778 339.63 7,557 509.45 11,335 679.27 15,113 849.08 18,892 1,018.90 22,670 1,188.72 26,448 76

77 184.75 3,928 369.50 7,856 554.25 11,784 739.00 15,712 923.75 19,640 1,108.50 23,567 1,293.25 27,495 77

78 201.34 4,091 402.68 8,183 604.03 12,274 805.37 16,365 1,006.71 20,457 1,208.05 24,548 1,409.39 28,639 78

79 219.75 4,279 439.50 8,557 659.25 12,836 879.00 17,114 1,098.75 21,393 1,318.50 25,672 1,538.25 29,950 79

80 240.13 4,511 480.27 9,021 720.40 13,532 960.53 18,043 1,200.67 22,554 1,440.80 27,064 1,680.93 31,575 80

This rate insert is for use with materials for accounts sitused in Maryland, and is not to be used on its own.

¹ CV @ age 65 or 10 years - Value shown is at attained age 65 or the end of year 10 if later, and assumes all premiums have been paid, no changes have been made to the certificate, and there is no certificate debt.

EXCLUSIONS AND LIMITATIONS: Suicide Exclusion - If a covered person commits suicide, the death benefit may be limited to the premiums paid for that covered person.

Pre-existing Condition Limitation - The Accelerated Death Benefit for Long Term Care with Restoration of Benefits and Extension of Benefits (GWCLTCRE, GWCLTCRE1) rider may contain a pre-existing condition limitation.

Other Exclusions and Limitations - The policy and riders (if included) have other elimination periods, exclusions and limitations that may affect coverage.

Please refer to the certificate for details.

Rates shown are based on Tobacco/Non-tobacco, Issue Age Specific rating structure. MONTHLY means 12 times per year.

This information is valid as long as information remains current, but in no event later than 12/31/2026. Group Whole Life Insurance benefits are provided under form GWLC, or state

variations thereof. Rider benefits are provided under the following forms, or state variations thereof: Accelerated Death Benefit for Terminal Illness or Condition (GWPTI) and

Accelerated Death Benefit for Long Term Care with Restoration of Benefits and Extension of Benefits (GWCLTCRE, GWCLTCRE1). Allstate Benefits is the marketing name used by

American Heritage Life Insurance Company

This is a brief overview of the benefits available under the group voluntary policy underwritten by American Heritage Life Insurance Company (Home Office, Jacksonville, FL). (Home Office, Jacksonville, FL), a subsidiary of The

Allstate Corporation. ©2025 Allstate Insurance

Details of the insurance, including exclusions, restrictions, and other provisions are included in the certificates issued. Company. www.allstate.com or

For additional information, you may contact your Allstate Benefits Representative. allstatebenefits.com

HO Use Only: Andrew-20250519-8082-MD-

TNTS-B_STD_-FALSE-10-FA-10000-75000-

† Issue Ages 18-70 Only for Accelerated Death Benefit for Long Term Care with Restoration of Benefits and Extension of Benefits (GWCLTCRE, GWCLTCRE1).

10000-PI:E-12x-TI:T-PWP:F-ADB:F-TYT:0-

GWCLTCRE:T-CT:F-ST:F-UWR

Ratecard generated May 19, 2025 - 2:13 PM by ABQuote 04.30.2025.

ABJ20743-28125 page 4 of 4 FOR AGENT USE ONLY