Page 182 - WCPP Annual Report 2021-22_Draft #7.6.2

P. 182

Annual Report for the 2021/22 Financial Year

Vote 2: Western Cape Provincial Parliament

Part E: Financial Information for the year ended 31 March 2022

Notes to the Annual Financial Statements

Figures in Rand 2022 2021

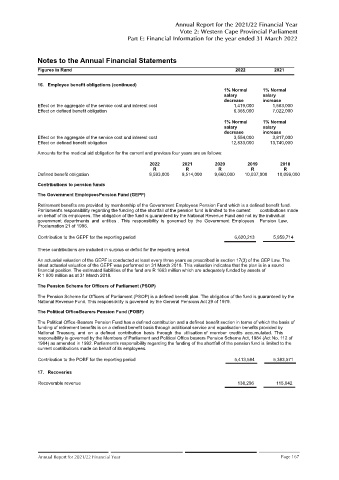

16. Employee benefit obligations (continued)

1% Normal 1% Normal

salary salary

decrease increase

Effect on the aggregate of the service cost and interest cost 1,419,000 1,583,000

Effect on defined benefit obligation 6,365,000 7,022,000

1% Normal 1% Normal

salary salary

decrease increase

Effect on the aggregate of the service cost and interest cost 3,554,000 3,817,000

Effect on defined benefit obligation 12,833,000 13,740,000

Amounts for the medical aid obligation for the current and previous four years are as follows:

2022 2021 2020 2019 2018

R R R R R

Defined benefit obligation 8,593,000 9,514,000 9,660,000 10,037,000 10,099,000

Contributions to pension funds

The Government Employees Pension Fund (GEPF)

Retirement benefits are provided by membership of the Government Employees Pension Fund which is a defined benefit fund.

Parliament's responsibility regarding the funding of the shortfall of the pension fund is limited to the current contributions made

on behalf of its employees. The obligation of the fund is guaranteed by the National Revenue Fund and not by the individual

government departments and entities . This responsibility is governed by the Government Employees Pension Law,

Proclamation 21 of 1996.

Contribution to the GEPF for the reporting period 6,620,213 5,959,714

These contributions are included in surplus or deficit for the reporting period.

An actuarial valuation of the GEPF is conducted at least every three years as prescribed in section 17(3) of the GEP Law. The

latest actuarial valuation of the GEPF was performed on 31 March 2018. This valuation indicates that the plan is in a sound

financial position. The estimated liabilities of the fund are R 1 663 million which are adequately funded by assets of

R 1 800 million as at 31 March 2018.

The Pension Scheme for Officers of Parliament (PSOP)

The Pension Scheme for Officers of Parliament (PSOP) is a defined benefit plan. The obligation of the fund is guaranteed by the

National Revenue Fund. This responsibility is governed by the General Pensions Act 29 of 1979.

The Political Office-Bearers Pension Fund (POBF)

The Political Office-Bearers Pension Fund has a defined contribution and a defined benefit section in terms of which the basis of

funding of retirement benefits is on a defined benefit basis through additional service and equalisation benefits provided by

National Treasury, and on a defined contribution basis through the utilisation of member credits accumulated. This

responsibility is governed by the Members of Parliament and Political Office bearers Pension Scheme Act, 1984 (Act No. 112 of

1984) as amended in 1992. Parliament's responsibility regarding the funding of the shortfall of the pension fund is limited to the

current contributions made on behalf of its employees.

Contribution to the POBF for the reporting period 5,413,584 5,383,571

17. Recoveries

Recoverable revenue 138,296 115,042

Annual Report for 2021/22 Financial Year Page 167