Page 21 - Justice AZHG

P. 21

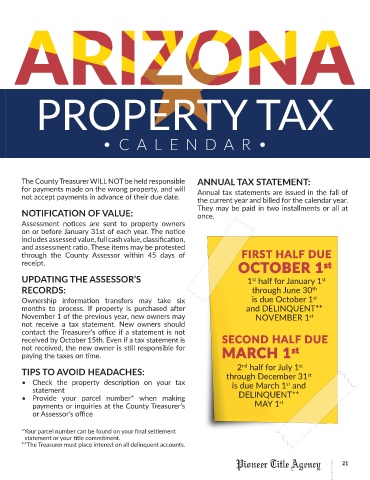

PROPERTY TAX

•CALEND AR•

The County Treasurer WILL NOT be held responsible ANNUAL TAX STATEMENT:

for payments made on the wrong property, and will Annual tax statements are issued in the fall of

not accept payments in advance of their due date. the current year and billed for the calendar year.

NOTIFICATION OF VALUE: They may be paid in two installments or all at

once.

Assessment notices are sent to property owners

on or before January 31st of each year. The notice

includes assessed value, full cash value, classification,

and assessment ratio. These items may be protested

through the County Assessor within 45 days of FIRST HALF DUE

receipt. OCTOBER 1 st

UPDATING THE ASSESSOR’S 1 half for January 1

st

st

RECORDS: through June 30

th

st

Ownership information transfers may take six is due October 1

months to process. If property is purchased after and DELINQUENT**

November 1 of the previous year, new owners may NOVEMBER 1 st

not receive a tax statement. New owners should

contact the Treasurer’s office if a statement is not

received by October 15th. Even if a tax statement is SECOND HALF DUE

not received, the new owner is still responsible for st

paying the taxes on time. MARCH 1

2 half for July 1

st

nd

TIPS TO AVOID HEADACHES: through December 31

st

• Check the property description on your tax is due March 1 and

st

statement

• Provide your parcel number* when making DELINQUENT**

payments or inquiries at the County Treasurer’s MAY 1 st

or Assessor’s office

*Your parcel number can be found on your final settlement

statement or your title commitment.

**The Treasurer must place interest on all delinquent accounts.

Pioneer Title Agency 21