Page 14 - QUALLS BG

P. 14

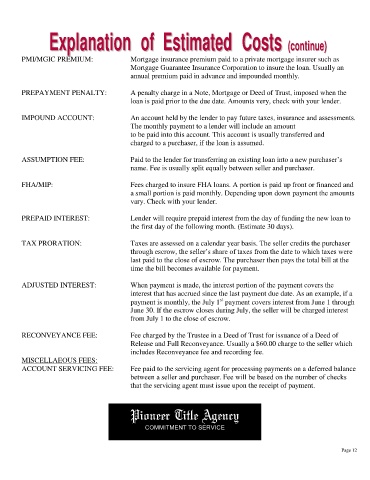

E Ex xp pl la an na at ti io on n o of f E Es st ti im ma at te ed d C Co os st ts s ( (c co on nt ti in nu ue e) )

PMI/MGIC PREMIUM: Mortgage insurance premium paid to a private mortgage insurer such as

Mortgage Guarantee Insurance Corporation to insure the loan. Usually an

annual premium paid in advance and impounded monthly.

PREPAYMENT PENALTY: A penalty charge in a Note, Mortgage or Deed of Trust, imposed when the

loan is paid prior to the due date. Amounts very, check with your lender.

IMPOUND ACCOUNT: An account held by the lender to pay future taxes, insurance and assessments.

The monthly payment to a lender will include an amount

to be paid into this account. This account is usually transferred and

charged to a purchaser, if the loan is assumed.

ASSUMPTION FEE: Paid to the lender for transferring an existing loan into a new purchaser’s

name. Fee is usually split equally between seller and purchaser.

FHA/MIP: Fees charged to insure FHA loans. A portion is paid up front or financed and

a small portion is paid monthly. Depending upon down payment the amounts

vary. Check with your lender.

PREPAID INTEREST: Lender will require prepaid interest from the day of funding the new loan to

the first day of the following month. (Estimate 30 days).

TAX PRORATION: Taxes are assessed on a calendar year basis. The seller credits the purchaser

through escrow, the seller’s share of taxes from the date to which taxes were

last paid to the close of escrow. The purchaser then pays the total bill at the

time the bill becomes available for payment.

ADJUSTED INTEREST: When payment is made, the interest portion of the payment covers the

interest that has accrued since the last payment due date. As an example, if a

payment is monthly, the July 1 payment covers interest from June 1 through

st

June 30. If the escrow closes during July, the seller will be charged interest

from July 1 to the close of escrow.

RECONVEYANCE FEE: Fee charged by the Trustee in a Deed of Trust for issuance of a Deed of

Release and Full Reconveyance. Usually a $60.00 charge to the seller which

includes Reconveyance fee and recording fee.

MISCELLAEOUS FEES:

ACCOUNT SERVICING FEE: Fee paid to the servicing agent for processing payments on a deferred balance

between a seller and purchaser. Fee will be based on the number of checks

that the servicing agent must issue upon the receipt of payment.

Pioneer Title Agency

ioneer Title Agency

COMMITMENT TO SERVICE

COMMITMENT TO SERVICE

Page 12