Page 25 - Felicia Mandell-Snell Buyer Guide

P. 25

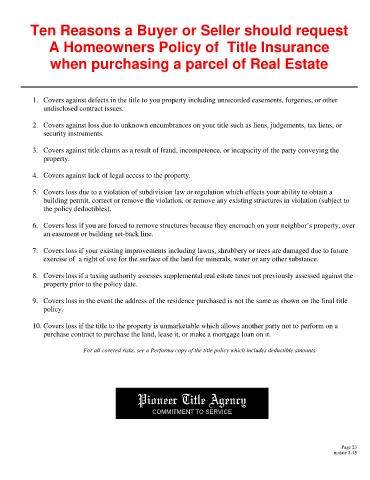

Ten Reasons a Buyer or Seller should request

A Homeowners Policy of Title Insurance

when purchasing a parcel of Real Estate

1. Covers against defects in the title to you property including unrecorded easements, forgeries, or other

undisclosed contract issues.

2. Covers against loss due to unknown encumbrances on your title such as liens, judgements, tax liens, or

security instruments.

3. Covers against title claims as a result of fraud, incompetence, or incapacity of the party conveying the

property.

4. Covers against lack of legal access to the property.

5. Covers loss due to a violation of subdivision law or regulation which effects your ability to obtain a

building permit, correct or remove the violation, or remove any existing structures in violation (subject to

the policy deductibles).

6. Covers loss if you are forced to remove structures because they encroach on your neighbor’s property, over

an easement or building set-back line.

7. Covers loss if your existing improvements including lawns, shrubbery or trees are damaged due to future

exercise of a right of use for the surface of the land for minerals, water or any other substance.

8. Covers loss if a taxing authority assesses supplemental real estate taxes not previously assessed against the

property prior to the policy date.

9. Covers loss in the event the address of the residence purchased is not the same as shown on the final title

policy.

10. Covers loss if the title to the property is unmarketable which allows another party not to perform on a

purchase contract to purchase the land, lease it, or make a mortgage loan on it.

For all covered risks, see a Performa copy of the title policy which includes deductible amounts.

Pioneer Title Agency

COMMITMENT TO SERVICE

Page 23

update 2-15