Page 20 - QUALLS SG

P. 20

FIRPTA

Foreign Investment in Real Property Tax Act

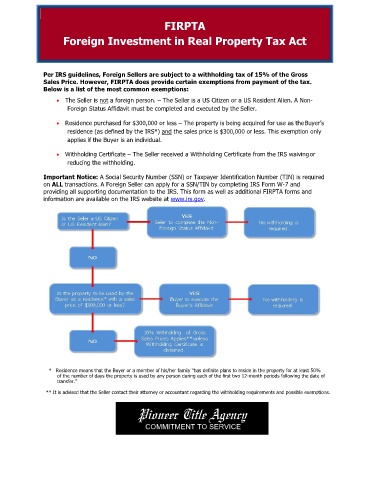

Per IRS guidelines, Foreign Sellers are subject to a withholding tax of 15% of the Gross

Sales Price. However, FIRPTA does provide certain exemptions from payment of the tax.

Below is a list of the most common exemptions:

• The Seller is not a foreign person. – The Seller is a US Citizen or a US Resident Alien. A Non-

Foreign Status Affidavit must be completed and executed by the Seller.

• Residence purchased for $300,000 or less – The property is being acquired for use as the Buyer’s

residence (as defined by the IRS*) and the sales price is $300,000 or less. This exemption only

applies if the Buyer is an individual.

• Withholding Certificate – The Seller received a Withholding Certificate from the IRS waiving or

reducing the withholding.

Important Notice: A Social Security Number (SSN) or Taxpayer Identification Number (TIN) is required

on ALL transactions. A Foreign Seller can apply for a SSN/TIN by completing IRS Form W-7 and

providing all supporting documentation to the IRS. This form as well as additional FIRPTA forms and

information are available on the IRS website at www.irs.gov.

* Residence means that the Buyer or a member of his/her family “has definite plans to reside in the property for at least 50%

of the number of days the property is used by any person during each of the first two 12-month periods following the date of

transfer.”

** It is advised that the Seller contact their attorney or accountant regarding the withholding requirements and possible exemptions.

Pioneer Title Agency

COMMITMENT TO SERVICE