Page 14 - NEW FOREX FULL COURSE

P. 14

FOREX TRADING COURSE FOR BEGINNERS

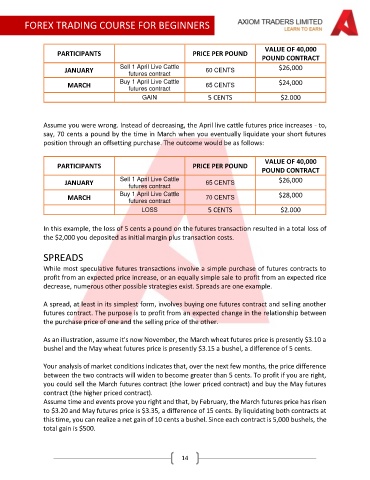

VALUE OF 40,000

PARTICIPANTS PRICE PER POUND

POUND CONTRACT

Sell 1 April Live Cattle $26,000

JANUARY 60 CENTS

futures contract

Buy 1 April Live Cattle $24,000

MARCH 65 CENTS

futures contract

GAIN 5 CENTS $2.000

Price per

Assume you were wrong. Instead of decreasing, the April live cattle futures price increases - to,

say, 70 cents a pound by the time in March when you eventually liquidate your short futures

position through an offsetting purchase. The outcome would be as follows:

VALUE OF 40,000

PARTICIPANTS PRICE PER POUND

POUND CONTRACT

Sell 1 April Live Cattle $26,000

JANUARY 65 CENTS

futures contract

Buy 1 April Live Cattle $28,000

MARCH 70 CENTS

futures contract

LOSS 5 CENTS $2.000

In this example, the loss of 5 cents a pound on the futures transaction resulted in a total loss of

the $2,000 you deposited as initial margin plus transaction costs.

SPREADS

While most speculative futures transactions involve a simple purchase of futures contracts to

profit from an expected price increase, or an equally simple sale to profit from an expected rice

decrease, numerous other possible strategies exist. Spreads are one example.

A spread, at least in its simplest form, involves buying one futures contract and selling another

futures contract. The purpose is to profit from an expected change in the relationship between

the purchase price of one and the selling price of the other.

As an illustration, assume it's now November, the March wheat futures price is presently $3.10 a

bushel and the May wheat futures price is presently $3.15 a bushel, a difference of 5 cents.

Your analysis of market conditions indicates that, over the next few months, the price difference

between the two contracts will widen to become greater than 5 cents. To profit if you are right,

you could sell the March futures contract (the lower priced contract) and buy the May futures

contract (the higher priced contract).

Assume time and events prove you right and that, by February, the March futures price has risen

to $3.20 and May futures price is $3.35, a difference of 15 cents. By liquidating both contracts at

this time, you can realize a net gain of 10 cents a bushel. Since each contract is 5,000 bushels, the

total gain is $500.

14