Page 14 - LRCC October 2025 Focus

P. 14

Sponsored

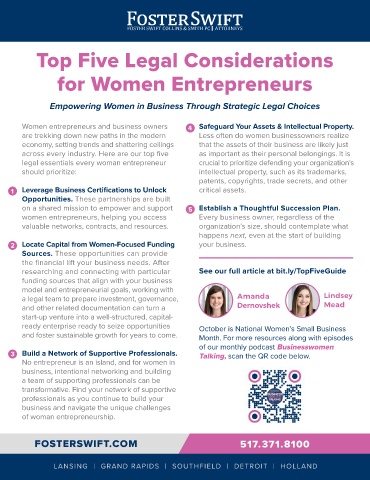

Top Five Legal Considerations

for Women Entrepreneurs

Empowering Women in Business Through Strategic Legal Choices

Women entrepreneurs and business owners 4 Safeguard Your Assets & Intellectual Property.

are trekking down new paths in the modern Less often do women businessowners realize

economy, setting trends and shattering ceilings that the assets of their business are likely just October 8, 2025, will mark 45 years for me

across every industry. Here are our top five as important as their personal belongings. It is in the Life Insurance Business.

legal essentials every woman entrepreneur crucial to prioritize defending your organization’s

should prioritize: intellectual property, such as its trademarks,

patents, copyrights, trade secrets, and other

1 Leverage Business Certifications to Unlock critical assets. es, that’s correct — the Life Insurance Business. I’ll never forget the Sunday morning call from his wife.

Her voice shook as she told me about the accident and

Today, that term is rarely used, and like the

Opportunities. These partnerships are built Ycompany I lead, Centennial Group, a member of asked if Danny’s policy was paid to date — and if the

on a shared mission to empower and support 5 Establish a Thoughtful Succession Plan. the Principal Financial Network, our name is more often claim would be honored. I was able to reassure her on

women entrepreneurs, helping you access Every business owner, regardless of the associated with Group Benefits, Pensions, Investment both points and let her know we would sit down to

valuable networks, contracts, and resources. organization’s size, should contemplate what Management Advice, and Individual Financial Planning. discuss how Danny’s decision would continue to provide

happens next, even at the start of building Over these 45 years, I’ve had the privilege of witnessing income for their family and protect the hopes and

dreams they still had.

2 Locate Capital from Women-Focused Funding your business. the miracle of life insurance firsthand. When someone

Sources. These opportunities can provide purchases a life insurance policy, it is always an act of Sadly, many families are not as fortunate. In recent years,

the financial lift your business needs. After love for someone else. I was reminded of this truth just we’ve all seen tragic stories — sometimes in headlines

researching and connecting with particular See our full article at bit.ly/TopFiveGuide last month, September, which is recognized as “Life or on social media — followed by well-intentioned

Insurance Awareness Month.”

fundraising campaigns. While platforms like GoFundMe

funding sources that align with your business can provide immediate relief, the help is typically

model and entrepreneurial goals, working with Let me share one experience from along this 45-year modest compared to a family’s long-term financial

a legal team to prepare investment, governance, Amanda Lindsey journey. I met a client I’ll call “Danny” on a beautiful needs. The grief of losing a loved one is overwhelming

and other related documentation can turn a Dernovshek Mead late-summer day. He had stopped by, curious about the enough without the added weight of financial insecurity.

renovation we had done on our then-headquarters, the

start-up venture into a well-structured, capital- old Greyhound Bus Station in Lansing. As I gave him a According to LIMRA (Life Insurance Marketing Research

ready enterprise ready to seize opportunities October is National Women’s Small Business tour, he spoke with pride about his young family and the Association), 55% of working adults say they have life

and foster sustainable growth for years to come. Month. For more resources along with episodes love of his life — his wife, a stay-at-home mom caring for insurance only through work. But employer coverage

their children.

is often a fraction of the 10 to 15 times annual income

of our monthly podcast Businesswomen that professionals — and even popular search engines

3 Build a Network of Supportive Professionals. Talking, scan the QR code below. It just so happened that this chance meeting took place — recommend. The loss of a family’s income provider is

No entrepreneur is an island, and for women in in September, during one of our industry awareness devastating, often in ways that aren’t fully realized until

business, intentional networking and building campaigns, which encouraged me to ask him, “Danny, it happens.

a team of supporting professionals can be do you own any life insurance?” Like so many people, his So, I urge anyone reading this: don’t leave the question

answer was “no.” After a short discussion, it became clear

transformative. Find your network of supportive to Danny that his family would be financially vulnerable to chance. Ask yourself today, “Do I own 10 to 15 times

professionals as you continue to build your if something happened to him. I reminded him that, my annual income in life insurance?” If the answer is no,

business and navigate the unique challenges at 38 years old, the right coverage could cost less than reach out to a trusted advisor to change it — or

of woman entrepreneurship. dinner out at a local restaurant each month. After visit lifehappens.org to find one. u

thoughtful consideration, Danny decided to act and put

a policy in place.

FOSTERSWIFT.COM 517.371.8100 Three years later, Danny was tragically killed doing the

work he loved as an electrician.

LANSING | GRAND RAPIDS | SOUTHFIELD | DETROIT | HOLLAND

e

b

m

r

g

or

.

a

nsi

a

14 FOCUS MAGAZINE | OCTOBER 2025 l lansingchamber.org 15 15

n

h

c

g